SCYNEXIS Reports Fourth Quarter and Full Year 2021 Financial Results

and Provides Corporate Update

|

• |

BREXAFEMME® (ibrexafungerp tablets), launched in August 2021, achieved net revenues of $1.1 million in 2021. Fourth quarter 2021 net revenues were $0.6 million. |

|

• |

As of the end of 2021, BREXAFEMME was covered by commercial insurance plans representing 81 million or 48% of commercially insured lives. |

|

• |

SCYNEXIS is initiating MARIO, a global Phase 3 study to evaluate ibrexafungerp as an oral step-down treatment for invasive candidiasis (IC) in the hospital setting, with enrollment expected to begin in Q2 2022, and the intravenous (IV) formulation of ibrexafungerp, after successful completion of Phase 1, is advancing to the next stage of development. |

|

• |

Based on cash balance at December 31, 2021 and operating plan, SCYNEXIS has a projected cash runway into the second quarter of 2023. |

|

• |

SCYNEXIS will host a conference call today, March 29 at 8:30 a.m. EDT |

JERSEY CITY, N.J., March 29, 2022 – SCYNEXIS, Inc. (NASDAQ: SCYX), a biotechnology company pioneering innovative medicines to overcome and prevent difficult-to-treat and drug-resistant infections, today reported financial results for the fourth quarter and full year ended on December 31, 2021.

“SCYNEXIS had an incredible year of accelerated growth and landmark accomplishments with the approval and launch of our first commercial product, BREXAFEMME® (ibrexafungerp tablets), as well as significant scientific advancement toward our goal to build a broad antifungal franchise for ibrexafungerp across multiple indications,” said Marco Taglietti, M.D., President and Chief Executive Officer of SCYNEXIS. “The coming year promises to be even more exciting as we continue our momentum by enlarging the prescriber base, expanding payer coverage, and growing BREXAFEMME revenues. Additionally, we plan to file a supplemental New Drug Application (sNDA) in recurrent vulvovaginal candidiasis (rVVC), and we anticipate receiving approval for this label expansion by the end of 2022.”

BREXAFEMME Commercial Update

|

|

• |

BREXAFEMME delivered $0.6 million in net sales in fourth quarter 2021 and $1.1 million in total net sales in 2021. According to IQVIA data, there were approximately 3,700 total prescriptions for BREXAFEMME written in Q4 2021, and more than 4,600 total prescriptions written in 2021. |

|

|

• |

BREXAFEMME was prescribed by over 1,600 healthcare providers (HCPs) in the fourth quarter, and 40% of these doctors expanded their use and prescribed the treatment to multiple patients during this period. |

|

|

• |

Commercial insurance coverage of BREXAFEMME continues to expand. As of the end of 2021, BREXAFEMME was covered by plans representing more than 81 million or 48% of commercially-insured lives. |

Ibrexafungerp Clinical Updates

|

|

• |

Reported positive results from the pivotal Phase 3 CANDLE study of oral ibrexafungerp for prevention of rVVC. In this international trial of 260 patients with rVVC, defined as three or more episodes of vulvovaginal candidiasis (VVC) in the previous 12 months, patients initially received a three day regimen of fluconazole to treat their current infection, and responders were randomized in the prevention phase to receive either 300 mg ibrexafungerp BID or matching placebo one day a month, for six months. The study showed that 65.4% of patients receiving ibrexafungerp achieved clinical success by having no recurrence at all, either culture-proven, presumed or suspected, through Week 24 compared to 53.1% of placebo-treated patients (p=0.02). The advantage of ibrexafungerp over placebo was sustained over the three-month follow-up period and remained statistically significant (p=0.034). Ibrexafungerp was generally safe and well-tolerated. There were no serious drug-related adverse events, and no patients treated with ibrexafungerp discontinued therapy due to adverse events. The most commonly reported events were headaches and gastrointestinal events, which were mostly mild and generally consistent with the current BREXAFEMME label. SCYNEXIS plans to submit the results in a supplemental NDA to the U.S. Food and Drug Administration (FDA) in the second quarter of 2022 and anticipates receiving approval by year-end. |

|

|

• |

Reached agreement with FDA on the regulatory path forward in invasive candidiasis (IC) infections in the hospital setting. The MARIO study, a global Phase 3 multi-center, prospective, randomized, double-blind study of two treatment regimens, will evaluate oral ibrexafungerp as an oral step-down treatment in patients suffering from IC compared to oral fluconazole. Eligible hospital patients with IC will receive treatment with IV echinocandin and will then be switched to either oral ibrexafungerp or oral fluconazole once step-down criteria are met. Approximately 220 patients will be enrolled and randomized in the study. The primary objective of the study is to determine whether treatment of IC with IV echinocandins followed by oral ibrexafungerp is as effective as treatment with IV echinocandins followed by oral fluconazole, the current standard of care. The primary end point of the study will be all-cause mortality at 30 days after initiation of antifungal therapy. |

|

|

• |

Received Orphan Medicinal Product Designation for ibrexafungerp by the European Medicines Agency (EMA) for the indication of invasive candidiasis. This designation will provide at least 10 years of market exclusivity in the EU for ibrexafungerp for invasive candidiasis. SCYNEXIS was also recently awarded a new patent in the U.S. and obtained allowance of an additional European patent application, expanding ibrexafungerp lifecycle protection to 2038. |

|

|

• |

Reported successful completion of a Phase 1 clinical study of liposomal IV formulation of ibrexafungerp. SCYNEXIS reported encouraging results and the successful completion of its Phase 1 randomized, double-blind, placebo-controlled single and multiple ascending dose study evaluating the safety, tolerability, and pharmacokinetics of the liposomal IV formulation of ibrexafungerp in healthy subjects. Dosing began in March 2021, and the last cohort completed in October 2021. Results from progressive ascending dosing to reach target exposure showed IV ibrexafungerp was |

|

|

generally well tolerated with no concerning safety findings, and SCYNEXIS is moving forward with next steps for this formulation. |

Ibrexafungerp Scientific Presentations and Publications

|

|

• |

Three presentations from an interim analysis of a Phase 3 open-label study (FURI) were presented at Virtual ID Week 2021 on September 29-October 3, 2021. These data support the favorable clinical activity of oral ibrexafungerp in severe hospital-based fungal infections across multiple indications, including refractory candidiasis, oropharyngeal and esophageal candidiasis, and in Candida bone and joint infections. Of the 74 patients treated with oral ibrexafungerp 62.1% achieved complete or partial response with another 24.3% showing stable disease. |

|

|

• |

Preclinical data supporting the potential of ibrexafungerp, to treat mucormycosis using an in vivo mouse model of mucormycosis, were presented at the 10th Trends in Medical Mycology (TIMM) meeting. On October 8-11, 2021, investigators presented findings, from an NIH-funded trial in which ibrexafungerp monotherapy demonstrated survival benefits equivalent to current standard of care treatments, including liposomal amphotericin B and posaconazole. Additionally, the study found when ibrexafungerp was combined with amphotericin B, synergistic benefits were observed with a significant enhancement in median survival time and overall survival when compared to any one therapy alone. Mucormycosis has an estimated 54% overall mortality rate. |

Corporate Developments

|

|

• |

Warrant exercises generated a combined $29.0 million in cash in the fourth quarter of 2021, further strengthening the balance sheet. On December 3, SCYNEXIS reported warrant exercises totaling $7.9 million and on December 22, the Company reported additional warrant exercises totaling $21.1 million. |

|

|

• |

SCYNEXIS received $4.7 million in non-dilutive proceeds in February 2022 from the sale of New Jersey State net operating losses to a third party. |

|

|

• |

SCYNEXIS received an additional $5.0 million in non-dilutive proceeds in March 2022 from the third tranche of the previously reported Term Loan Agreement with Hercules Capital/SVB upon achieving positive results from the Phase 3 CANDLE study of ibrexafungerp for the prevention of recurrent yeast infections. |

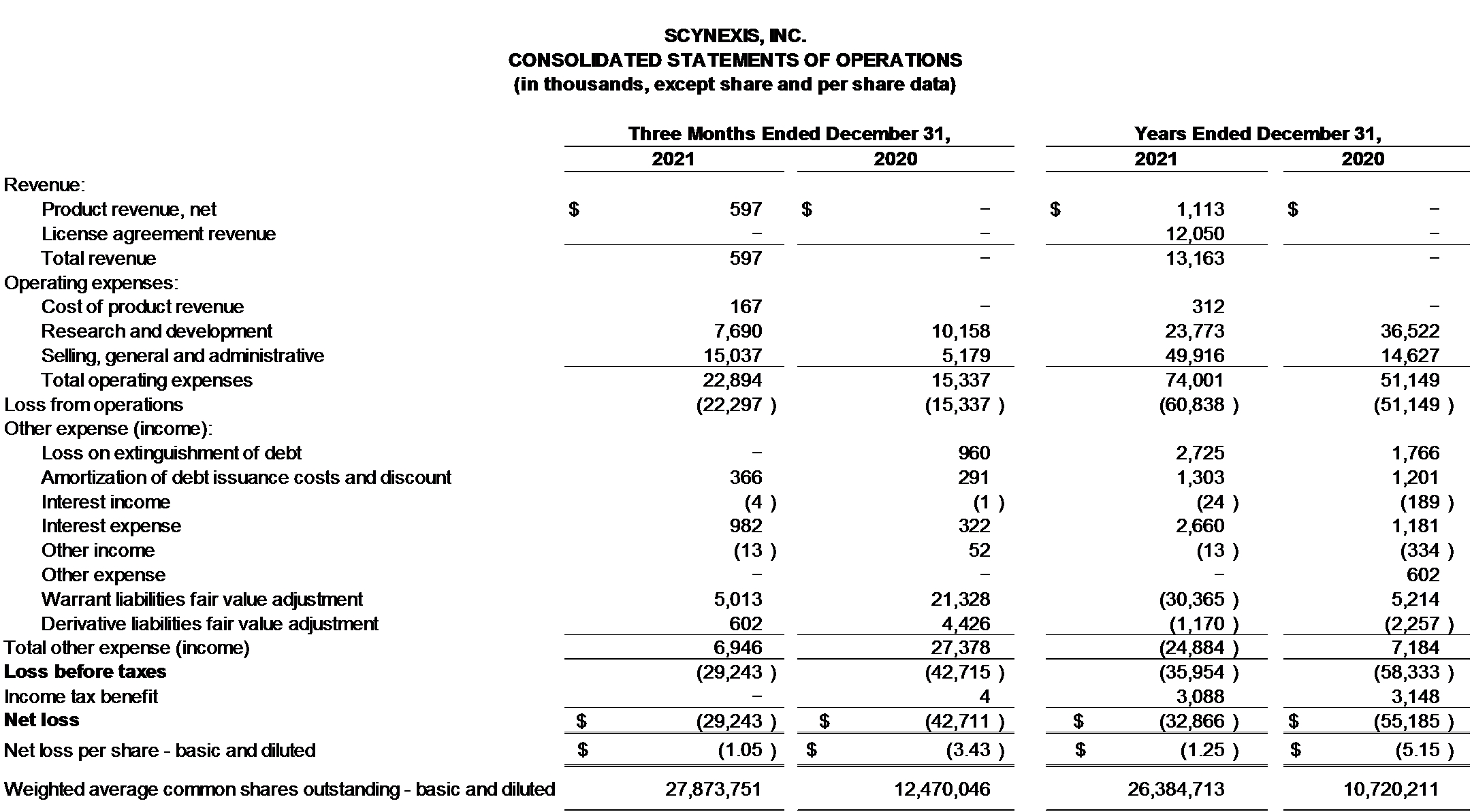

Fourth Quarter 2021 Financial Results

BREXAFEMME generated net product revenue of $0.6 million in the fourth quarter of 2021. The product was approved for sale by the FDA in June 2021.

Cost of product revenue was $0.2 million in the fourth quarter of 2021.

Research and development expense for the fourth quarter of 2021 decreased to $7.7 million from $10.2 million versus the fourth quarter of 2020. The decrease of $2.5 million, or 25%, was primarily driven by a decrease of $1.5 million in chemistry, manufacturing, and controls (CMC) expense, a decrease of $0.4 million in clinical development expense, a net decrease in other research and development expense of $0.8 million, offset in part by an increase of $0.2 million in regulatory expense.

Selling, general & administrative (SG&A) expense for the fourth quarter of 2021 increased to $15.0 million from $5.2 million versus the fourth quarter of 2020. The increase of $9.8 million, or 188%, was primarily driven by a $7.2 million increase in commercial expense, an increase of $0.5 million in salary related costs, an increase of $0.2 million in costs associated with information technology costs, and increases of $0.7 million each in professional fees and medical affairs expenses, all primarily due to the costs recognized to support the ongoing commercialization of BREXAFEMME

Total other expense was $6.9 million for the fourth quarter of 2021, versus total other expense of $27.4 million for the fourth quarter of 2020. During the fourth quarters of 2021 and 2020, SCYNEXIS recognized non-cash losses of $5.0 million and $21.3 million, respectively, on the fair value adjustment of the warrant liabilities and non-cash losses of $0.6 million and $4.4 million, respectively on the fair value adjustment of derivative liabilities.

Net loss for the fourth quarter of 2021, was $29.2 million, or $1.05 per share, compared to net loss of $42.7 million, or $3.43 per share for the fourth quarter of 2020.

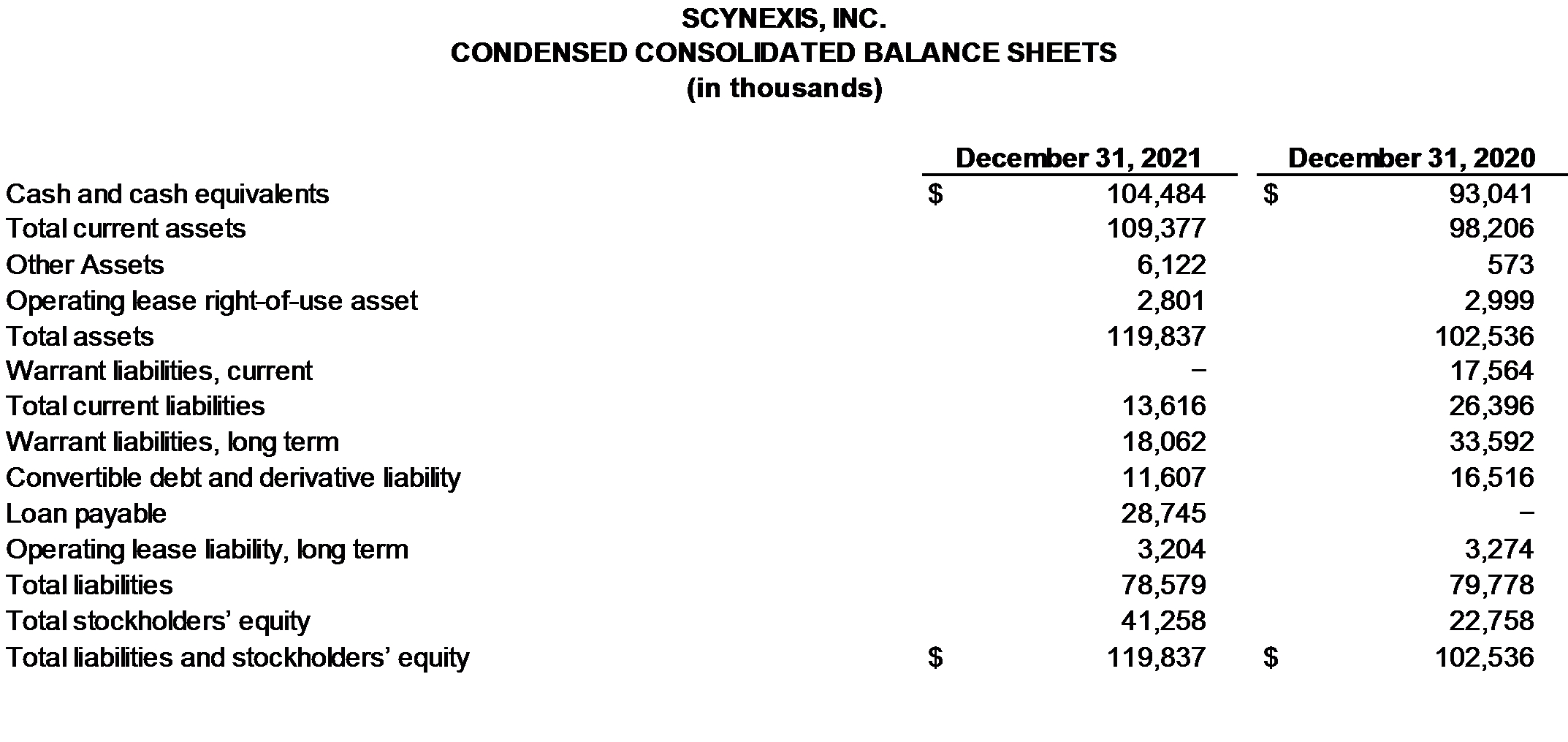

Full Year 2021 Financial Results

BREXAFEMME generated net product revenue of $1.1 million for the full year 2021.

Earlier in 2021, SCYNEXIS recognized $12.1 million in licensing revenue from Hansoh Pharma pursuant to an Exclusive License and Collaboration agreement related to the research, development and commercialization of ibrexafungerp in the Greater China region.

Cost of product revenue was $0.3 million for for the full year 2021.

Research and development expense for the full year 2021 decreased to $23.8 million from $36.5 million versus the comparable prior year. The decrease of $12.7 million, or 34.9%, was primarily driven by a decrease of $5.5 million in CMC, a decrease of $5.2 million in clinical development expense, a decrease of $0.9 million in preclinical expense, a decrease of $0.5 million in regulatory expense, and a net decrease in other research and development expense of $0.5 million.

SG&A expense for the full year 2021 increased to $49.9 million from $14.6 million versus the comparable prior year. The increase of $35.3 million, or 241.3%, was primarily driven by a $23.1 million increase in commercial expense, a $3.5 million increase in salary and other compensation related costs, a $2.6 million increase in medical affairs expense, and a $2.2 million increase in information technology costs, all primarily due to the costs recognized to support the ongoing commercialization of BREXAFEMME. The increase for the full year 2021, was also driven by an increase of $1.7 million in certain professional fees, a $1.2 million increase in business development expense associated with the licensing agreement entered into with Hansoh in February 2021, and a net increase of $1.0 million in other selling, general and administrative expense.

Total other income was $24.9 million for the full year 2021, versus total other expense of $7.2 million for the comparable prior year. During the full years 2021 and 2020, SCYNEXIS recognized a non-cash gain of $30.4 million and a non-cash loss of $5.2 million, respectively, on the fair value adjustment of the warrant liabilities and non-cash gains of $1.2 million and $2.3 million, respectively, on the fair value adjustment of derivative liabilities.

Net loss for the full year 2021, was $32.9 million, or $1.25 per share, compared to net loss of $55.2 million, or $5.15 per share for the comparable prior year.

Cash Balance

Cash and cash equivalents totaled $104.5 million on December 31, 2021, compared to $93.0 million in cash, and cash equivalents on December 31, 2020. Based upon its existing operating plan, the Company believes that its existing cash and cash equivalents, the funding of $5.0 million from the third tranche of the previously reported Term Loan Agreement with Hercules Capital/SVB for positive CANDLE study top-line data, and receipt of $4.7 million in conjunction with the sale of New Jersey Net Operating Losses will enable us to fund our operating requirements into the second quarter of 2023.

Conference call and webcast details

A conference call to discuss the results will be held at 8:30 a.m. EDT

Investors (domestic): (877) 705-6003

Investors (international): (201) 493-6725

Conference ID: 13727358

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1531381&tp_key=627476145d

About Ibrexafungerp

Ibrexafungerp [pronounced eye-BREX-ah-FUN-jerp] is an antifungal agent and the first representative of a novel class of structurally-distinct glucan synthase inhibitors, triterpenoids. This agent combines the well-established activity of glucan synthase inhibitors with the potential flexibility of having oral and intravenous (IV) formulations. Ibrexafungerp is in late-stage development for multiple indications, including life-threatening fungal infections caused primarily by Candida (including C. auris) and Aspergillus species in hospitalized patients. It has demonstrated broad-spectrum antifungal activity, in vitro and in vivo, against multidrug-resistant pathogens, including azole- and echinocandin-resistant strains. The U.S. Food and Drug Administration (FDA) granted ibrexafungerp Qualified Infectious Disease Product (QIDP) and Fast Track designations for the IV and oral formulations of ibrexafungerp for the indications of invasive candidiasis (IC) (including candidemia) and invasive aspergillosis (IA) and has granted Orphan Drug Designation for the IC and IA indications. Ibrexafungerp is formerly known as SCY-078.

About SCYNEXIS

SCYNEXIS, Inc. (NASDAQ: SCYX) is a biotechnology company pioneering innovative medicines to help millions of patients worldwide overcome and prevent difficult-to-treat infections that are becoming increasingly drug-resistant. SCYNEXIS scientists are developing the company’s lead asset, ibrexafungerp (formerly known as SCY-078), as a broad-spectrum, systemic antifungal for multiple fungal indications in both the community and hospital settings. SCYNEXIS has initiated the launch of its first commercial product in the U.S., BREXAFEMME® (ibrexafungerp tablets). The U.S. Food and Drug Administration (FDA) approved BREXAFEMME on June 1, 2021. In addition, late-stage clinical investigation of ibrexafungerp for the prevention of recurrent Vulvovaginal Candidiasis (VVC) and the treatment of life-threatening invasive fungal infections in hospitalized patients is ongoing. For more information, visit www.scynexis.com.

Forward-Looking Statements

Statements contained in this press release regarding expected future events or results are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements regarding: SCYNEXIS’ accelerated growth and advancement toward our goal to build a broad antifungal franchise for ibrexafungerp across multiple indications; enlarging the prescriber base, expanding payer coverage, and growing BREXAFEMME revenues; our plan to file a supplemental New Drug Application (sNDA) in recurrent vulvovaginal candidiasis (rVVC) and receive approval for this label expansion by the end of 2022; enrollment in the MARIO study; advancement of out IV formulation; and our cash runway into the second quarter of 2023. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited, to: BREXAFEMME may not be accepted by physicians and patients at the rate SCYNEXIS expects; risks inherent in SCYNEXIS' ability to successfully develop and obtain FDA approval for ibrexafungerp for additional indications; unexpected delays may occur in the timing of acceptance by the FDA of an NDA submission; the expected costs of studies and when they might begin or be concluded; SCYNEXIS’ need for additional capital resources; and SCYNEXIS' reliance on third parties to conduct SCYNEXIS' clinical studies and commercialize its products. These and other risks are described more fully in SCYNEXIS' filings with the Securities and Exchange Commission, including without limitation, its most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q, including in each case under the caption "Risk Factors," and in other documents subsequently filed with or furnished to the Securities and Exchange Commission. All forward-looking statements contained in this press release speak only as of the date on which they were made. SCYNEXIS undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

CONTACT:

Investor Relations

Irina Koffler

LifeSci Advisors

Tel: (646) 970-4681

ikoffler@lifesciadvisors.com

Media Relations

Gloria Gasaatura

LifeSci Communications

Tel: (646) 970-4688

ggasaatura@lifescicomms.com