UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE FISCAL YEAR ENDED December 31, 2017

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

FOR THE TRANSITION PERIOD FROM TO

Commission File Number 001-36365

SCYNEXIS, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

56-2181648 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

101 Hudson Street Suite 3610 Jersey City, NJ |

|

07302 - 6548 |

|

(Address of principal executive offices) |

|

(Zip Code) |

(201) 884-5485

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange on Which Registered |

|

Common Stock, par value $0.001 per share |

|

The NASDAQ Stock Market LLC |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

☐ (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

☒ |

|

|

|

|

|

|

|

|

|

Emerging growth company |

|

☒ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant based upon the closing price of its Common Stock on the Nasdaq Global Market on June 30, 2017 was $46,517,308. Excludes 490,728 shares of the registrant's Common Stock held by

executive officers and directors outstanding at June 30, 2017. Exclusion of such shares should not be construed to indicate that any such person possesses the power, direct or indirect, to direct or cause the direction of the management or policies of the registrant or that such person is controlled by or under common control with the registrant.

As of March 8, 2018, there were 46,837,435 shares of the registrant’s Common Stock outstanding.

Documents Incorporated by Reference

Portions of the registrant’s proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the registrant’s 2018 Annual Meeting of Stockholders, which will be filed subsequent to the date hereof, are incorporated by reference into Part III of this Form 10-K. Such proxy statement will be filed with the Securities and Exchange Commission not later than 120 days following the end of the registrant’s fiscal year ended December 31, 2017.

ANNUAL REPORT ON FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

TABLE OF CONTENTS

|

|

|

|

|

Item 1. |

4 |

|

|

Item 1A. |

17 |

|

|

Item 1B. |

38 |

|

|

Item 2. |

38 |

|

|

Item 3. |

39 |

|

|

Item 4. |

39 |

|

|

|

|

|

|

|

|

|

|

Item 5. |

40 |

|

|

Item 6. |

40 |

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

41 |

|

Item 7A. |

48 |

|

|

Item 8. |

49 |

|

|

Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

71 |

|

Item 9A. |

71 |

|

|

Item 9B. |

71 |

|

|

|

|

|

|

|

|

|

|

Item 10. |

72 |

|

|

Item 11. |

72 |

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholders Matters |

72 |

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

72 |

|

Item 14. |

72 |

|

|

|

|

|

|

|

|

|

|

Item 15. |

73 |

|

|

Item 16. |

75 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “project,” “predict,” “potential” and similar expressions intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance, time frames or achievements to be materially different from any future results, performance, time frames or achievements expressed or implied by the forward-looking statements. We discuss many of these risks, uncertainties and other factors in this Annual Report on Form 10-K in greater detail under the heading “Risk Factors.” Given these risks, uncertainties and other factors, you should not place undue reliance on these forward-looking statements. Also, these forward-looking statements represent our estimates and assumptions only as of the date of this filing. You should read this Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. We hereby qualify our forward-looking statements by our cautionary statements. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

Overview

SCYNEXIS, Inc. is a biotechnology company committed to positively impacting the lives of patients suffering from difficult-to-treat and often life-threatening infections by delivering innovative anti-infective therapies. We are developing our lead product candidate, SCY-078, as the first representative of a novel oral and intravenous (IV) triterpenoid antifungal family in clinical development for the treatment of several serious fungal infections, including invasive candidiasis, invasive aspergillosis, refractory invasive fungal infections and vulvovaginal candidiasis (VVC). SCY-078 is a structurally distinct glucan synthase inhibitor that has been shown to be effective in vitro and in vivo against a broad range of human fungi pathogens such as Candida and Aspergillus species, including multidrug-resistant strains, as well as Pneumocystis species. Candida and Aspergillus species are the fungi responsible for approximately 85% of all invasive fungal infections in the United States (U.S.) and Europe. To date, we have characterized the pharmacokinetics and safety profile of oral and IV formulations of SCY-078 in multiple Phase 1 studies. In a Phase 2 study, evaluating oral SCY-078 as a step-down therapy in patients with invasive candidiasis, we confirmed that oral SCY-078 achieved the intended plasma exposure for efficacy and was well-tolerated. In another Phase 2 proof-of-concept study, evaluating oral SCY-078 in patients with VVC, we observed numerically higher clinical cure rates at test-of-cure visit and fewer recurrences of infection at the four-month follow-up when compared to oral fluconazole, the standard of care (SoC). We applied to the U.S. Food and Drug Administration (FDA) for, and received, the designation of the oral tablet and IV formulations of SCY-078 for invasive candidiasis and invasive aspergillosis as Qualified Infectious Disease Product, or QIDP, under the Generating Antibiotic Incentives Now Act, or GAIN Act. We also applied to the FDA for, and were granted, Fast Track designation for SCY-078 for these indications.

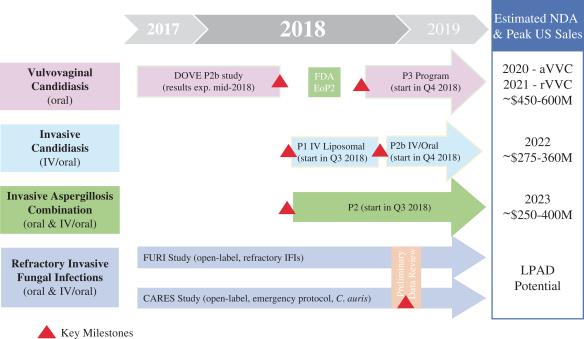

Our Platform of Indications

We continue to accelerate and expand our clinical programs, leveraging the versatility of the SCY-078 platform, including the potential for oral SCY-078 to be a suitable treatment for indications with significant unmet medical needs and considerable commercial opportunity. The following table summarizes the indications we are currently seeking, anticipated NDA submission timing and estimated peak sales in the United States:

4

VVC—Our most advanced stage of clinical development, targeting both acute and recurrent infections.

We are currently enrolling patients in a Phase 2b dose-finding study of oral SCY-078 for the treatment of VVC (DOVE study). The DOVE study is a randomized, multicenter, double-blind, active-controlled, dose-finding study designed to evaluate the safety and efficacy of oral SCY-078 versus oral fluconazole in adult female patients. Approximately 180 patients with moderate to severe acute VVC are being randomized to one of five different regimens of oral SCY-078 or oral fluconazole, the current standard of care (SoC). Efficacy will be measured by the percentage of patients with clinical cure (complete resolution of signs and symptoms) at the test-of-cure visit at day 10 (primary endpoint) and at a follow-up visit on day 25. Mycological eradication (negative fungal culture) will also be evaluated at the same time points. Robust enrollment in the study has been maintained and we expect to report top-line results for this study in mid-2018. If successful, following completion of the DOVE study and following an End-of-Phase 2 meeting with the FDA, we plan to study the dose regimen selected from this study in a subsequent Phase 3 program, potentially initiating in the fourth quarter of 2018 with the objective of filing the New Drug Application (NDA) for acute VVC in 2020.

Invasive Candidiasis—Path forward established for IV program of SCY-078, with clinical trials to initiate in the third quarter of 2018 with an improved IV formulation.

As previously disclosed in March 2017, the FDA required us to hold the initiation of any new clinical studies with a cyclodextrin-based IV formulation of SCY-078 following the review of three mild-to-moderate inflammation-related thrombotic events observed in healthy volunteers receiving the highest dose level of a cyclodextrin-based IV formulation of SCY-078 in a Phase 1 study. Based on subsequent interactions with the FDA, we completed a broad range of pre-clinical activities designed to identify whether the underlying cause of the thrombotic events was related to the active ingredient, SCY-078, or the administration regimen for the cyclodextrin-based IV formulation of SCY-078. Several pre-clinical studies showed that SCY-078 does not affect blood coagulation by itself, providing supporting evidence that the thrombotic events associated with the administration of the cyclodextrin-based IV formulation were triggered by vascular endothelium inflammation at the site of infusion where the concentration of the cyclodextrin-based formulation of SCY-078 was greatest.

In parallel, we continued our pursuit of alternative IV formulations and accelerated the development of a new formulation based on liposomal technology that has been successfully used to improve systemic tolerability of other commercially available IV formulations, including IV antifungals. In comparing the cyclodextrin-based IV formulation head-to-head against the liposomal IV formulation of SCY-078 in pre-clinical evaluations, the liposomal formulation showed a superior profile for infusion-related and vascular inflammation tolerability. Based on these initial pre-clinical studies, we believe that the liposomal IV formulation may offer significant clinical benefits over the cyclodextrin-based IV formulation and, therefore decided to focus our efforts on the advancement of the liposomal IV formulation of SCY-078. This decision was discussed with the FDA and a path forward was established. IND-enabling pre-clinical studies with the liposomal formulation are ongoing, and we anticipate initiating a Phase 1 study in healthy volunteers with the liposomal IV formulation of SCY-078 in the third quarter of 2018. If successful, following completion of the Phase 1 study and pending FDA’s review, we plan to initiate a Phase 2b IV-

5

Oral step-down study of SCY-078 in invasive candidiasis patients with the liposomal IV and oral formulations of SCY-078 in the fourth quarter of 2018.

Invasive Aspergillosis—SCY-078 in combination with standard of care may represent a significant opportunity to improve outcomes for this high-mortality infection.

Based on promising pre-clinical data with combination use of SCY-078 with SoC vs. Aspergillus spp., we plan to initiate a Phase 2 study of oral SCY-078 in patients with invasive aspergillosis in the third quarter of 2018. This initial study is planned as a randomized, double-blind trial with the objective of assessing the safety and efficacy of oral SCY-078 in combination with a mold active azole therapy, the SoC for this indication, compared to SoC alone. We believe that SCY-078’s broad activity against Aspergillus spp., including azole-resistant strains, along with its minimal drug-drug interactions, high tissue penetration into the lungs and oral formulation allowing for long-term administration, may make it an ideal candidate for use as combination therapy to provide improved outcomes vs. SoC.

Refractory Invasive Fungal Infections—Potential for streamlined development pathway.

We are currently enrolling patients in the FURI study, a global, open-label study in which oral SCY-078 is being administered to patients with invasive fungal infections that are refractory to, or that are intolerant of, standard therapy (azoles, echinocandins and/or polyenes). Twenty-four locations in the U.S. and Europe are now active in this study and enrollment is progressing. We also initiated the CARES study, a global, open-label study of oral SCY-078 for the treatment of Candida auris infections. Candida auris has been classified by the Centers for Disease Control and Prevention (CDC) as a serious public health threat, as it is multidrug-resistant, has resulted in high mortality rates (up to 60%) and can be spread from patients (and surfaces) to patients, resulting in hospital outbreaks. The CARES study is intended to provide rapid access to oral SCY-078 for patients suffering from this life-threatening infection.

The open-label designs of the FURI and CARES studies allow for evaluation of the data on an interim basis to further inform subsequent regulatory steps of the development program. We believe that compelling data from the FURI and/or CARES studies could allow SCY-078 to become eligible for the regulatory Limited Population Pathway for Antibacterial and Antifungal Drugs (LPAD) potentially resulting in an initial NDA based on streamlined development. We plan to continue to advance enrollment in the FURI and CARES studies, both in the U.S. and globally, with preliminary data review planned for the fourth quarter of 2018.

Key milestones

We believe we will achieve the following key milestones in 2018:

|

|

• |

|

to complete enrollment and announce top-line study results of the DOVE Phase 2b study of oral SCY-078 as a treatment for VVC in mid-2018 and initiate the Phase 3 VVC program in the fourth quarter of 2018 following an end-of-Phase 2 meeting with the FDA; |

|

|

• |

|

to initiate the Phase 1 clinical trial to evaluate the safety and tolerability of the liposomal IV formulation of SCY-078 in healthy volunteers in the third quarter of 2018. If successful, following completion of the Phase 1 study, initiate a Phase 2b clinical trial designed to evaluate IV/oral SCY-078 for the treatment of invasive candidiasis in the fourth quarter of 2018; |

|

|

• |

|

to initiate a Phase 2 study of oral SCY-078 in combination with current standard of care (azole) as a treatment for invasive aspergillosis in the third quarter of 2018; and |

|

|

• |

|

to continue to advance enrollment in both the FURI and CARES studies, both in the U.S. and globally, with preliminary data review planned for the fourth quarter of 2018. |

Our Strategy

Key elements of our strategy include:

|

|

• |

|

to further develop SCY-078 and obtain regulatory approval in major commercial markets for our key initial indications: VVC (acute and recurrent), invasive candidiasis and invasive aspergillosis; |

|

|

• |

|

to commercialize SCY-078 for selected indications in the U.S. through a dedicated commercial team, including field force; |

|

|

• |

|

to contract with commercial partners to develop and commercialize SCY-078 outside of the U.S.; |

|

|

• |

|

to assess external opportunities to expand our clinical pipeline; and |

|

|

• |

|

to leverage our strong scientific team to pursue the development of other internal proprietary compounds. |

6

Market Opportunity

Acute and Recurrent VVC

VVC, commonly known as a “vaginal yeast infection,” is the second most common cause of vaginitis and it is usually caused by Candida spp. It affects approximately 70%-75% of women at least once in their lifetime, with 40-50% of these women experiencing more than one episode. VVC episodes include the following:

|

|

• |

|

Uncomplicated cases. These are sporadic mild-to-moderate infections typically caused by C. albicans spp. in a normal host. They represent the majority of the VVC episodes; and |

|

|

• |

|

Complicated cases. These represent the remaining episodes and include: severe infections, recurrent cases, infections caused by non-albicans Candida spp., and/or observed in an abnormal host. |

VVC can be associated with substantial morbidity, including significant genital discomfort, reduced sexual pleasure, psychological distress and loss of productivity. The global diagnosis and treatment, along with lost productivity, is estimated to cost $1.0 billion per year in the U.S.

Current treatments for acute VVC include OTC topical azole antifungals (clotrimazole, miconazole, and others) and the use of the prescription oral azole antifungal, fluconazole. Fluconazole is the only orally-administered antifungal currently approved for acute VVC in the U.S., with a therapeutic cure rate of 55% as reported in its label. Uncomplicated acute VVC cases are often effectively treated with topical agents and/or with one to three doses of oral fluconazole. However, management of VVC during pregnancy, moderate-to-severe VVC, recurrent VVC and VVC caused by fluconazole-resistant Candida spp., are not fully addressed by oral fluconazole. In addition, there are no oral alternatives for VVC patients who do not respond to or tolerate fluconazole, and there are no FDA-approved products for the treatment of recurrent VVC. We believe that SCY-078, if approved for the treatment of acute and recurrent VVC, may provide a significant benefit for patients not satisfied with existing therapies.

Invasive Candidiasis

Invasive Candidiasis is a serious fungal infection caused by various species of the Candida infection that occurs in immunocompromised patients. The current treatment algorithm for invasive candidiasis infections includes empiric treatment, confirmed treatment, and maintenance step-down treatment as defined below:

|

|

• |

|

Empiric Treatment. The rapid progression of disease and high mortality rates associated with documented invasive fungal infections often result in antifungal therapy being administered in the hospital in suspected (unconfirmed) cases; |

|

|

• |

|

Confirmed Treatment. Once a Candida infection is confirmed (via blood culture or rapid diagnostic) treatment begins in the hospital setting, as it occurs most commonly in ICU and surgical patients, patients using a central venous catheter, and immunosuppressed patients; and |

|

|

• |

|

Maintenance Step-down Treatment. Depending on the risk factors of patients, some of them may be allowed to continue treatment with oral step-down therapy in the outpatient setting. Treatment should continue for two weeks after signs and symptoms have resolved and Candida yeasts are no longer in the bloodstream. |

Current treatment guidelines for invasive candidiasis in the U.S. and in Europe recommend the use of IV echinocandins (the only glucan synthase inhibitor currently commercially available) as first-line therapy for empiric and confirmed cases. The main limitation of the echinocandin class is that only IV administration is available, limiting the flexibility of stepping down to an oral therapy in the same treatment class. The only option currently available to step down to an oral therapy after initial IV echinocandin are the azoles (the only antifungal class orally bioavailable).

Despite existing antifungal agents, mortality in this high-risk patient population remains high at approximately 30-40%. In addition, the increasing rate of drug-resistant Candida strains has created a need for new treatments. The CDC has listed fluconazole-resistant Candida as a serious threat requiring prompt and sustained action and has also identified a rise in echinocandin resistance, especially among Candida glabrata. In June 2016, the CDC issued an extraordinary alert for healthcare facilities and providers to be on the lookout for patients with C. auris, a multidrug-resistant strain with high mortality (approximately 60%). We believe that SCY-078, if approved for the treatment of invasive candidiasis, may provide an alternative to current IV echinocandin use in empiric and confirmed cases, and fulfill the significant current unmet needs in the oral maintenance setting.

7

Invasive Aspergillosis is a serious fungal infection caused by Aspergillus species. The infection is reported to be the leading infection-caused death in immunocompromised patients. Current treatment guidelines in the U.S. and in Europe recommend the use of azoles (itraconazole, voriconazole or isavuconazole) as the initial first-line therapy. However, patients face unsatisfactory clinical outcomes with mortality rates ranging from 30% to 80% (depending on the stage of infection and the host underlying disease) and long treatment durations. Additionally, current therapies often exhibit drug-drug interaction, and the recent emergence of A. fumigatus azole resistance is increasingly becoming of clinical concern worldwide.

Due to the significant rate of resistance in some countries (i.e., Netherlands ~10-20%), combination antifungal therapy as first-line treatment for patients suspected of invasive aspergillosis is recommended. The combination of voriconazole or isavuconazole with an IV echinocandin is recommended at least until results of resistance testing are obtained. A previous study, by Marr et al. in invasive aspergillosis patients demonstrated that the combination of an IV echinocandin and an IV/oral azole for two weeks followed by an oral azole alone for four additional weeks improved outcomes in certain patient subgroups. In this study, the combination regimen was given for only two weeks because of the limitations of using an IV echinocandin long-term in the outpatient setting. We believe that SCY-078, if approved in combination with standard of care for the treatment of invasive aspergillosis, would allow patients to receive the required combination treatment for the full six to twelve weeks of therapy, possibly leading to better outcomes.

SCY-078 Target Product Profile

SCY-078, a triterpenoid analogue, represents a new chemical class which acts through the inhibition of the glucan synthase, an established target in antifungal therapeutics. SCY-078 is being developed as oral and IV formulations and has demonstrated potent activity against a large collection of medically relevant strains of Candida and Aspergillus species, including multi-drug resistant strains, as well as Pneumocystis species. Additionally, SCY-078 has shown in vitro and in vivo activity against multi-drug resistant organism such as Candida auris and synergistic/additive activity in combination with isavuconazole against Aspergillus strains. SCY-078 has unique attributes that define its potential to address significant unmet medical needs and market opportunities, including:

|

|

• |

broad activity against Candida, Aspergillus, and Pneumocystis strains; |

|

|

• |

activity against azole and most echinocandin-resistant Candida strains, including multi-drug resistant strains; |

|

|

• |

activity against azole-resistant Aspergillus strains; |

|

|

• |

only glucan synthase inhibitor with both oral and IV formulations in clinical development, allowing for first-line treatment, oral step-down with the same agent and longer duration of treatment; |

|

|

• |

distinct chemical structure from other glucan synthase inhibitors, providing a unique spectrum of activity and pharmacokinetic profile; |

|

|

• |

fungicidal (i.e., killing the fungi) capabilities against Candida species compared to azoles, which are fungistatic (i.e., inhibiting the growth of fungi); |

|

|

• |

high tissue penetration, allowing high concentrations in the organs commonly affected by fungal infections; and |

|

|

• |

Enhanced activity at acidic pH (normal vaginal pH is 3.8 to 4.5). |

We believe that SCY-078, if approved, has the potential to address significant gaps with commercially available therapies in the following indications:

|

|

• |

acute moderate-severe and recurrent vulvovaginal candidiasis; |

|

|

• |

invasive candidiasis (including resistant infections); and |

|

|

• |

invasive aspergillosis (including resistant infections). |

In the future, we may also consider other indications for SCY-078 for which longer oral antifungal regimens are typically needed and would benefit from the broad spectrum of activity, favorable safety profile and low potential for drug-drug interactions, including for the treatment of chronic fungal infections and for prophylaxis use.

Treatment of VVC. If SCY-078 is approved for the treatment of VVC, it could provide a first-line therapy for recurrent VVC, for which there is currently no approved treatment, and be the only oral, non-azole, fungicidal treatment for moderate and severe acute cases of VVC. We believe that SCY-078’s broad spectrum activity (including fluconazole-resistant strains), its enhanced activity at acidic pH and its high penetration in the vaginal tissue, may allow SCY-078 to address the current unmet needs in this indication and improve the quality-of-life of these patients. Additionally, in contrast with fluconazole that is fungistatic against Candida spp., SCY-078 is fungicidal against most Candida isolates. We believe that SCY-078’s “cidal” activity (i.e., killing the pathogen) may provide an advantage in preventing recurrences.

8

Treatment of invasive Candida infections. If SCY-078 is approved for the treatment of invasive Candida infections, we believe it could complement or replace IV echinocandins as the drug of choice for these infections because of its broader spectrum of activity and its availability in both IV and oral forms. Having both formulations would allow physicians and their patients to start and stay on a single effective therapy for both inpatient and outpatient settings. Transitioning patients from hospital-based care to outpatient care is key to potentially reduce, or eliminate, expensive hospital stays and risks of hospital-acquired infections. Given the growing emergence of fluconazole-resistant Candida in hospital settings, SCY-078 could also be used as the step-down therapy from any IV echinocandin, replacing fluconazole, and providing the advantage of continuing the antifungal treatment with an oral glucan synthase inhibitor that has a broader spectrum of activity than fluconazole.

Treatment of invasive Aspergillus infections. We believe that SCY-078's broad activity against Aspergillus spp., including azole-resistant strains, along with its minimal drug-drug interactions, high tissue penetration into the lungs and oral formulation allowing for long-term administration, may make it an ideal candidate for use as combination therapy. If the combination of SCY-078 and standard of care is approved for the treatment of invasive Aspergillus infections and provides a significant improvement in clinical outcomes, “SCY-078 combo” could replace the azole as the treatment of choice for this difficult-to-treat infection. We recently reported data showing synergistic activity of SCY-078 in combination with an azole in both in vitro and in vivo models of invasive aspergillosis. A previous study, by Marr et al. in invasive aspergillosis demonstrated that the combination of an IV echinocandin and an azole for two weeks followed by an oral azole alone for four additional weeks improved outcomes in certain patient subgroups. In this study, the combination regimen of an IV echinocandin with an azole was given for only two weeks, because of the limitations of using an IV echinocandin long-term in the outpatient setting. A combination of SCY-078 and an azole would allow patients with invasive aspergillosis to receive this combination for the full six to twelve weeks of therapy, possibly leading to better outcomes.

Treatment of refractory invasive fungal infections. SCY-078 has been shown to be effective pre-clinically against Candida species resistant to azoles, including C. auris, C. albicans, C. glabrata and C. krusei. In addition, SCY-078 has been shown to be effective in vitro against the majority of echinocandin-resistant Candida strains tested. Candida auris has been classified by the Centers for Disease Control and Prevention (CDC) as a serious public health threat, as it is multidrug-resistant, has resulted in high mortality rates (up to 60%) and can be spread from patients (and surfaces) to patients, resulting in hospital outbreaks. The current refractory invasive fungal infections open-label studies (CARES and FURI) may provide SCY-078 the opportunity to become eligible for the regulatory Limited Population Pathway for Antibacterial and Antifungal Drugs (LPAD) potentially resulting in an initial New Drug Application (NDA) based on streamlined development. If approved, we believe SCY-078 has the potential to become the treatment of choice in this patient population.

Given our stage of development, we have not yet established a commercial organization or distribution capabilities.

For the treatment of VVC, we anticipate that prescribing physicians will mostly be obstetricians and gynecologists and likely a number of primary care physicians and, we believe, it may require a specific sales and marketing force with a women's health focus. We will assess our global commercial strategy for VVC in the future.

For the treatment of invasive fungal infections, we expect that prescribing physicians for the treatment of invasive fungal infections will be located at major medical centers, where physicians specializing in critical care, infectious disease specialists, and physicians treating immune compromised or immuno-suppressed patients, such as oncologists and those performing solid organ transplants and stem cell transplants, are likely to be found. For these indications, we intend to form our own focused hospital-based field force to target physicians in the U.S. Outside of the U.S., subject to obtaining necessary marketing approvals, we will likely seek to commercialize SCY-078 through distribution or other collaboration arrangements.

Competition for SCY-078

Our competitors include large pharmaceutical and biotechnology companies, and specialty pharmaceutical and generic drug companies. The three leading branded antifungal drugs representing one from each main class are as follows:

Azoles (2016 worldwide sales of $800.0 million). Noxafil® (posaconazole) marketed by Merck and Cresemba® (isavuconazole), recently approved in the U.S. and other global markets and marketed by Astellas in the U.S.;

Echinocandins (2016 worldwide sales of $1.0 billion). Cancidas® (caspofungin), a product that became generic in March 2017. Pfizer also markets the echinocandin Eraxis® (anidulafungin) and Astellas markets the echinocandin Mycamine® (micafungin); and

Polyenes (2016 worldwide sales of $500.0 million). AmBisome® (liposomal amphotericin B), a product sold by Gilead in Europe, by Astellas in the U.S. and by Dainippon-Sumitomo in Japan.

Pfizer, Merck, Astellas, and Gilead are all large pharmaceutical companies with significant experience and financial resources in the marketing and sale of specialty pharmaceuticals. Various other producers market and sell generic oral voriconazole, fluconazole and itraconazole.

Further, we expect that product candidates currently in clinical development may represent significant competition, if approved. These include the triazole VT-1161 being developed by Viamet Pharmaceuticals, Inc. (assets recently acquired by

9

NovaQuest Capital Management, LLC), the long-acting IV echinocandin CD101 being developed by Cidara Therapeutics, Inc., APX-001 developed by Amplyx Pharmaceuticals Inc., the polyene amphotericin B oral formulation MAT2203 developed by Matinas BioPharma Holdings Inc., F901318 developed by F2G Limited and VL2397 developed by Vical Incorporated. These companies may have greater resources than ours.

We believe that SCY-078 has the ability to perform well in the future fungal infection market given the sparse competitive marketplace, the unmet medical need, and the high mortality rate of these infections. The key competitive factors affecting the success of SCY-078, if approved, are likely to be its efficacy, safety, convenience, price, use in outpatient settings, the level of generic competition and the availability of reimbursement from government and other third-party payors. If approved, we believe that SCY-078’s unique features, including being a novel antifungal class, broad-spectrum of activity including resistant strains, IV and oral formulations, fungicidal activity versus Candida, high tissue penetration, and favorable safety profile, will differentiate it from competing products and allow premium pricing to generics and other competing products.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient or are less expensive than products that we may develop. Our competitors also may obtain FDA, or other regulatory, approval for their products more rapidly than we may obtain approval for ours. In addition, our ability to compete may be affected because in many cases insurers or other third-party payors seek to encourage the use of generic products. In the azole class, fluconazole, itraconazole, and oral voriconazole are generic. Caspofungin, the largest selling echinocandin, is now available on a generic basis. If approved, we believe SCY-078 will be capable of delivering value supportive of premium pricing over competitive generic products.

SCY-078 Development

We initially discovered and developed SCY-078 through a research collaboration with Merck Sharp & Dohme Corp., or Merck, a subsidiary of Merck & Co., Inc., and in May 2013 we acquired worldwide rights to SCY-078 in the field of human health. The compound is derived, by chemical modification, from enfumafungin, a natural product, and shows antifungal activity against Candida and Aspergillus through inhibition of glucan synthesis, a similar mechanism of action to the echinocandin class. SCY-078 has shown fungicidal activity against clinically relevant Candida species and potent in vitro activity against strains of Candida that are resistant to azoles and echinocandins and azole-resistant Aspergillus species. We have reported potent antifungal in vitro activity of SCY-078 against the multidrug resistant pathogen Candida auris, which has been classified by the CDC as an emerging serious global health threat. SCY-078 is the first representative of new class of antifungal agents, triterpenoid analogue (a novel and structurally distinct glucan synthase inhibitor), that retains antifungal activity against the majority of echinocandin-resistant strains, suggesting that SCY-078 acts on the fungal cell wall in a manner distinct from the echinocandins.

We are developing both IV and oral formulations of SCY-078. Patients with invasive fungal infections are typically prescribed IV treatment in hospitals and then are switched, or “stepped down,” to oral formulations to complete their antifungal treatment after they have shown sufficient improvement. The duration of the entire antifungal regimen (IV and oral) varies depending on the response to the antifungal treatment and the type of infection. Per current guidelines, invasive candidiasis patients are treated for at least two weeks after negative cultures are obtained and invasive aspergillosis patients are typically treated for six to 12 weeks. The availability of SCY-078 in both oral and IV formulations would allow for maximum flexibility in the administration of the same agent during the entire antifungal regimen. The IV formulation would allow initiation of treatment in critically ill patients for whom IV therapy is preferred. The oral formulation would allow step-down from the initial IV antifungal agent (either SCY-078 or echinocandins) to complete the antifungal regimen, as well as initiation of therapy in outpatient settings for those conditions that do not require hospitalization, such as VVC.

In animal models of invasive fungal infections used to test other drugs that have proven to be effective in humans, SCY-078 was shown to be highly active against Candida spp. These studies determined the drug concentrations in blood required to achieve efficacy. These correlations of drug exposure to drug activity, or PK/PD, have been used to identify the predicted human exposure of SCY-078 believed to be required to achieve efficacy (i.e., target exposure). Phase 1 and Phase 2 studies of SCY-078 indicate that the target exposure is achievable in humans at doses and regimens expected to be safe and adequately tolerated.

To date, more than 400 subjects and patients have received SCY-078 either orally, by IV, or by IV followed by oral. The most commonly reported adverse events after oral administration have been gastrointestinal events (i.e., nausea, diarrhea, vomiting). The gastrointestinal (GI) events reported have typically been transient (i.e., short duration), mild or moderate and not leading to discontinuation. The most commonly reported adverse events after IV administration of SCY-078 have been local reactions at the site of infusion. During our Phase 1 IV program in healthy volunteers, we observed three mild-to-moderate thrombotic events in healthy volunteers receiving the cyclodextrin-based IV formulation of SCY-078 at the highest doses and highest concentrations in a Phase 1 study. Based on these events, the FDA required us to hold the initiation of any new clinical studies with the IV formulation of SCY-078. We completed a broad range of pre-clinical activities designed to identify the underlying cause of the thrombotic events and to evaluate the optimal administration regimen for IV formulations of SCY-078. Several pre-clinical studies showed that SCY-078 does not affect blood coagulation by itself, providing

10

supporting evidence that the thrombotic events were triggered by vascular endothelium inflammation at the site of infusion. We identified a new formulation based on liposomal technology that our preclinical evaluations indicate has a superior profile for infusion-related and vascular inflammation tolerability when compared with the cyclodextrin-based IV formulation. Subsequent development activities for the IV formulation will be carried out with the new liposomal based formulation.

Serious Adverse Events (SAEs) are common when conducting clinical trials in a seriously ill population such as patients experiencing invasive candidiasis. Several SAEs have been reported in our clinical trials but only four of the events have been deemed by the investigator to be potentially related to SCY-078, although other contributing factors could not be ruled out. These four SAEs include: one event of elevation of liver function tests in a subject who received a single dose of oral SCY-078 (resolved) and three events secondary to thrombi formation at site of IV infusion (resolved) using the cyclodextrin-based IV formulation of SCY-078.

SCY-078 is protected by an issued composition of matter patent in the United States, which expires in 2030. The composition of matter patent has been granted in 63 countries and is pending in 19 other countries. Additional patent applications related to SCY-078 salts and polymorphs, and its use as an antifungal agent, have been filed and are currently pending. If granted, the new patent families will extend the patent protection of SCY-078 salts, including the citrate salt currently under development, up to 2036.

Preclinical Characterization of SCY-078

SCY-078 has broad antifungal activity based on a proven mechanism of action

SCY-078 is a potent inhibitor of the synthesis of the polymer beta (1,3)-D-glucan, an essential component of the fungal cell walls of Candida and Aspergillus species. Glucan synthesis inhibition is a clinically proven antifungal mechanism of action, as demonstrated by the echinocandin class of antifungal agents. The activity of SCY-078 observed against the majority of echinocandin-resistant strains suggests that SCY-078 acts in a manner distinct from the echinocandins. SCY-078 has been shown to have potent activity in vitro against clinically relevant Candida and Aspergillus species, including isolates that are resistant to currently available antifungal therapies. Azole-resistance among Candida and Aspergillus species is a global concern, particularly considering that azoles are the only antifungal class used to treat these life-threatening conditions that can be administered orally. SCY-078 retains its antifungal potency against fungal strains that are resistant to azoles. Echinocandin resistance is increasing in prevalence, particularly among azole-resistant species such as Candida glabrata. SCY-078 retained in vitro activity against a majority of echinocandin-resistant Candida glabrata strains we have tested. Multidrug resistance has been reported in several strains of Candida; particularly concerning is the emergence of C.auris that exhibits high rates of resistance to two or more antifungals. Thus, SCY-078 may offer a therapeutic option against multidrug resistant strains such as those that have emerged in C. glabrata and C. auris. In addition, SCY-078 has shown to have activity against Pneumocystis spp.

Nonclinical toxicology is supportive of continued development

The preclinical safety of SCY-078 has been evaluated in multiple studies in rats, dogs, rabbits, and non-human primates. The SCY-078 toxicology program was expanded to include three-month oral dose studies in two species (rats and dogs). Consistent with findings from prior non-clinical toxicology studies of shorter durations, we believe that these longer-term toxicity studies confirmed the favorable safety profile of oral SCY-078. Chronic (six-month rat, nine-month dog) oral dose studies are currently ongoing. These studies will allow flexible treatment regimens of SCY-078 beyond three months in our next stages of clinical development, which is particularly relevant for patients with invasive aspergillosis or refractory fungal infections.

Manufacturing and Supply of SCY-078

We have agreements with external vendors that are capable of supplying kilogram quantities of drug substance and of producing drug product to support ongoing and planned clinical trials. However, we do not own or operate and do not intend to own or operate facilities for manufacturing, storage and distribution, or testing of drug substance or drug product. We have relied on third-party contract manufacturers for synthesis of our clinical compounds and manufacture of drug product. We expect to continue to rely on either existing or alternative third-party manufacturers to supply SCY-078 for ongoing and planned clinical trials and for commercial production.

SCY-078 is a semi-synthetic compound. Thus, the manufacturing process for SCY-078 involves fermentation and synthetic chemical steps. The synthetic process does not require any specialized equipment and uses readily sourced intermediates. At commercial launch, we expect cost of goods for SCY-078 to be similar to that of other small molecule drugs. We have negotiated agreements with suppliers to produce both drug product and drug substance for our current needs. In the future, we plan to validate the process with selected vendors and secondary suppliers to establish a secure supply chain that could enable commercialization.

We estimate our supplies on hand for both oral and IV formulations of SCY-078 are sufficient to supply our ongoing and planned clinical trials. Manufacture of additional supplies of SCY-078 drug substance is planned to support any further

11

optimization of either of the formulations, if needed. Additional batches of both oral and IV SCY-078 drug product will be manufactured as needed to support the subsequent stages of our clinical development plan.

A drug manufacturing program subject to extensive governmental regulations requires robust quality assurance systems and experienced personnel with the relevant technical and regulatory expertise as well as strong project management skills. We believe we have a team that is capable of managing these activities. The third-party vendors that currently manufacture clinical supplies to support our ongoing clinical studies have the necessary capabilities and are in compliance with cGMP appropriate for the current stage of development.

The third-party vendors we will select to support our manufacturing and supply program both for future late-stage development and commercial readiness activities will have the required capabilities with respect to facilities, equipment and technical expertise, quality systems that meet global regulatory and compliance requirements, satisfactory regulatory inspection history from relevant health authorities and proven track records in supplying drug substance and drug product for late-stage clinical and commercial use.

Research and Development Expenses

A significant portion of our operating expenses is related to research and development and we intend to maintain our strong commitment to research and development. In fiscal years 2017 and 2016, we incurred $18.3 million and $20.1 million, respectively, on research and development expenses. See "Item 8. Financial Statements and Supplementary Data" of this Annual Report on Form 10-K for costs and expenses related to research and development, and other financial information for each of the fiscal years 2017 and 2016.

Collaborations and Licensing Agreements Associated with Our Core Drug Development Operations

We currently have a number of licensing and collaboration agreements associated with our core drug development operations, including the following:

Merck

We initially discovered and developed SCY-078 through a research collaboration with Merck Sharp & Dohme Corp., or "Merck", a subsidiary of Merck & Co., Inc. In May 2013, Merck transferred to us all development and commercialization rights for SCY-078 (also known as MK-3118). This decision was made following a review and prioritization of Merck’s infectious disease portfolio. Under the terms of the agreement, we received all human health rights to SCY-078, including all related technical documents, preclinical data, data from the seven Phase 1 trials conducted by Merck, and drug product and drug substance. The agreement continues until expiration of all royalty obligations. The agreement may be terminated if either party is in material breach and fails to remedy the breach after receiving written notice. In January 2014, Merck assigned the patents to us related to SCY-078 that it had exclusively licensed to us. Under the terms of the patent assignment, Merck no longer has responsibility to maintain the patents. Merck is eligible to receive milestones upon initiation of a Phase 3 clinical study, NDA filing and marketing approvals in each of the U.S., major European markets and Japan that could total up to $19 million. In addition, Merck will receive tiered royalties based on worldwide sales of SCY-078. The aggregate royalties are in the single digit percentages of net sales, and we expect to pay royalties on net sales of SCY-078 to Merck for no more than ten years from first commercial launch, on a country-by-country basis.

In December 2014, we entered into an amendment to the license agreement with Merck that defers the remittance of a milestone payment due to Merck, such that no amount will be due upon initiation of the first phase 2 clinical trial of a product containing the SCY-078 compound (the "Deferred Milestone"). The amendment also increased, in an amount equal to the Deferred Milestone, the milestone payment that will be due upon initiation of the first Phase 3 clinical trial of a product containing the SCY-078 compound. In December 2016 and January 2018, we entered into second and third amendments to the license agreement with Merck which clarified what would constitute the initiation of a Phase 3 clinical trial for the purpose of a milestone payment. Except as described above, all other terms and provisions of the license agreement remain in full force and effect.

R-Pharm

In August 2013, we entered into an agreement with R-Pharm, CJSC, or "R-Pharm", a leading supplier of hospital drugs in Russia, granting them exclusive rights to develop and commercialize SCY-078 in the field of human health in Russia, Turkey, and certain Balkan, Central Asian, Middle Eastern and North African countries. We retained the right to commercialize SCY-078 in the Americas, Europe, and Asia. We received an upfront payment of $1.5 million and are entitled to receive up to $18 million in payments if certain development and sales based milestones are achieved. We are also entitled to single digit percent royalty payments for products that do not fall under the patents and a royalty percentage in the teens for products that do fall under the patents. This agreement expires upon R-Pharm’s last royalty payment, which is the later of 12 years from the first registration of the product in the countries where R-Pharm’s license rights exist under this agreement, or the last to expire of the patents in such countries. Either party may terminate this agreement if the other party breaches and fails to remedy the breach after receiving notice from the non-breaching party. We have the ability to terminate this agreement if we determine that

12

R-Pharm fails to make reasonable progress in the development and commercialization of SCY-078. If we give R-Pharm notice of failure to make reasonable progress, R-Pharm will have the opportunity to correct the deficiencies.

The original agreement also included terms whereby R-Pharm would reimburse us for certain research and development costs associated with Phase 2 and Phase 3 clinical trials of oral SCY-078 and the development of an IV formulation of SCY-078. However, these cost reimbursement terms required that the clinical trials and the IV formulation development follow a global development plan that was agreed upon by both parties in August 2013. Subsequent to August 2013, modifications were made to the global development plan that caused the clinical trial cost reimbursement terms in the original agreement to no longer be enforceable. Further, the IV formulation development cost reimbursement terms in the original agreement did not specify which IV formulation and development costs were reimbursable by R-Pharm. In November 2014, we entered into a supplemental arrangement with R-Pharm, whereby R-Pharm was informed of the modified IV formulation development plan and R-Pharm agreed to reimburse us for specifically identified IV formulation development and manufacturing costs incurred by us. The specifically identified costs were defined as all costs incurred by us under a separate arrangement we have with a third-party service provider, whereby the third-party service provider is performing certain IV formulation and development services for us. We estimate that total reimbursable costs pursuant to the original agreement and supplemental arrangement with R-Pharm will be approximately $1.3 to $1.9 million.

Government Regulation

Government regulation

Government authorities in the United States, at the federal, state and local level, and in other countries extensively regulate, among other things, the research, development, testing, manufacture, including any manufacturing changes, packaging, storage, recordkeeping, labeling, advertising, promotion, distribution, marketing, import and export of pharmaceutical products such as those we are developing. The processes for obtaining regulatory approvals in the United States and in foreign countries, along with subsequent compliance with applicable statutes and regulations, require the expenditure of substantial time and financial resources.

U.S. drug approval process

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act, or FDCA, and implementing regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process or after approval, may subject an applicant to a variety of administrative or judicial sanctions, such as the FDA’s refusal to approve pending NDAs, withdrawal of an approval, imposition of a clinical hold, issuance of warning letters, product recall requests, product seizures, total or partial suspension of production or distribution, injunctions, refusals of government contracts, restitution, disgorgement or civil or criminal penalties.

The process required by the FDA before a drug may be marketed in the United States generally involves the following:

|

|

• |

completion of preclinical laboratory tests, animal studies and formulation studies in compliance with the FDA’s good laboratory practice, or GLP, regulations; |

|

|

• |

submission to the FDA of an investigational new drug application, or IND, which must become effective before human clinical trials may begin; |

|

|

• |

approval by an independent institutional review board, or IRB, at each clinical site before each trial may be initiated; |

|

|

• |

performance of adequate and well-controlled human clinical trials in accordance with good clinical practice, or GCP, to establish the safety and efficacy of the proposed drug for each indication, subject to on-going IRB review; |

|

|

• |

submission to the FDA of an NDA; |

|

|

• |

satisfactory completion of an FDA advisory committee review, if applicable; |

|

|

• |

satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product is produced to assess compliance with current Good manufacturing practice, or cGMP, regulations and guidance, and to assure that the facilities, methods and controls are adequate to preserve the drug’s identity, strength, quality and purity; and |

|

|

• |

FDA review and approval of the NDA. |

Preclinical studies

Preclinical studies include laboratory evaluation of product chemistry, toxicity and formulation, as well as animal studies to assess potential safety and efficacy. An IND sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data and any available clinical data or literature, among other things, to the FDA as part

13

of an IND. Some preclinical testing may continue even after the IND is submitted. An IND automatically becomes effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to one or more proposed clinical trials and places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. As a result, submission of an IND may not result in the FDA allowing clinical trials to commence.

Clinical trials

Clinical trials involve the administration of the investigational new drug to human subjects under the supervision of qualified investigators in accordance with GCP requirements, which include the requirement that all research subjects provide their informed consent in writing for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. In addition, an IRB at each institution participating in the clinical trial must review and approve the plan for any clinical trial before it commences at that institution. Information about certain clinical trials must be submitted within specific timeframes to the National Institutes of Health, or NIH, for public dissemination on their ClinicalTrials.gov website.

Human clinical trials are typically conducted in three sequential phases, which in some cases may overlap or be combined:

Phase 1: The drug is initially introduced into healthy human subjects or patients with the target disease or condition and tested for safety, dosage tolerance, absorption, metabolism, distribution, excretion and, if possible, to gain an early indication of its effectiveness.

Phase 2: The drug is administered to a limited patient population with the target disease to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage.

Phase 3: The drug is administered to an expanded patient population with the target disease, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate enough data to statistically evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product.

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and more frequently if serious adverse events occur. Phase 1, Phase 2 and Phase 3 clinical trials sometimes cannot be completed successfully within any specified period, or at all. Furthermore, the FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients.

In some cases, the FDA may condition approval of an NDA for a product candidate on the sponsor’s agreement to conduct additional clinical trials to further assess the drug’s safety and effectiveness after NDA approval. Such post-approval trials are typically referred to as Phase 4 studies.

In some circumstances, the FDA may also order a sponsor to conduct post-approval clinical trials if new safety information arises raising questions about the drug’s risk-benefit profile. Those clinical trials are typically referred to as Post-Marketing Requirements, or PMRs.

GAIN Act

The FDA has various expedited development programs, including break-through therapy, fast track designation and priority review, that are intended to expedite or simplify the process for the development and FDA review of drugs that meet certain qualifications. The purpose of these programs is to provide important new drugs to patients earlier than under standard FDA review procedures.

The GAIN Act is intended to encourage development of new antibacterial and antifungal drugs for the treatment of serious or life-threatening infections by providing certain benefits to sponsors, including extended exclusivity periods, fast track and priority review. To be eligible for these benefits a product in development must seek and be awarded designation as a Qualifying Infectious Disease Product, or QIDP.

To qualify as a QIDP according to the criteria established in the GAIN Act, a product must be an antibacterial or antifungal drug for human use intended to treat serious or life-threatening infections, including, those:

|

|

(1) |

caused by an antifungal resistant pathogen, including novel or emerging infectious pathogens; or |

|

|

(2) |

qualifying pathogens listed by the FDA in accordance with the GAIN Act. |

14

The FDA is required to facilitate the development, and expedite the review, of drugs that are intended for the treatment of a serious or life-threatening disease or condition for which there is no effective treatment and which demonstrate the potential to address unmet medical needs for the condition. Under the Fast Track program, the sponsor of a new drug candidate may request that the FDA designate the drug candidate for a specific indication as a Fast Track drug concurrent with, or after, the filing of the IND for the drug candidate. The FDA must determine if the drug candidate qualifies for Fast Track designation within 60 days of receipt of the sponsor's request.

If a drug candidate is granted Fast Track designation, the sponsor may engage in more frequent interactions with the FDA, and the FDA may review sections of the NDA before the application is complete. This rolling review is available if the applicant provides, and the FDA approves, a schedule for the submission of the remaining information and the applicant pays applicable user fees. However, the FDA's time period goal for reviewing an application does not begin until the last section of the NDA is submitted. Additionally, Fast Track designation may be withdrawn by the FDA if the FDA believes that the designation is no longer supported by data emerging in the clinical trial process.

Pediatric exclusivity

Pediatric exclusivity is another type of non-patent marketing exclusivity in the United States and, if granted, provides for the attachment of an additional six months of regulatory protection to the term of any existing exclusivity, including the non-patent exclusivity periods described above, and to the regulatory term of any patent that has been submitted to FDA for the approved drug product. This six-month exclusivity may be granted based on the voluntary completion of a pediatric study or studies in accordance with an FDA-issued “Written Request” for such a study or studies.

Qualified Infectious Disease Product exclusivity

If the NDA for a QIDP is approved by the FDA, the FDA will extend by an additional five years any non-patent marketing exclusivity period awarded, such as a five-year exclusivity period awarded for a new chemical entity. This extension is in addition to any pediatric exclusivity extension awarded. Eligibility for the extension will be denied if the product is approved for uses that would not meet the definition of a QIDP.

Foreign regulation

To market any product outside of the United States, we would need to comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy and governing, among other things, clinical trials, marketing authorization, commercial sales and distribution of our products. Whether or not we obtain FDA approval for a product, we would need to obtain the necessary approvals by the comparable regulatory authorities of foreign countries before we can commence clinical trials or marketing of the product in those countries. The approval process varies from country to country and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from and be longer than that required to obtain FDA approval. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others.

Pharmaceutical coverage, pricing and reimbursement

Our ability to commercialize our product candidates successfully will depend in part on the extent to which the United States and foreign governmental authorities, private health insurers and other third-party payors establish appropriate coverage and reimbursement levels for our product candidates and related treatments. In many of the markets where we would commercialize a product following regulatory approval, the prices of pharmaceutical products are subject to direct price controls (by law) and to drug reimbursement programs with varying price control mechanisms. Public and private health care payors control costs and influence drug pricing through a variety of mechanisms, including through negotiating discounts with the manufacturers and through the use of tiered formularies and other mechanisms that provide preferential access to certain drugs over others within a therapeutic class. Payors also set other criteria to govern the uses of a drug that will be deemed medically appropriate and therefore reimbursed or otherwise covered. In particular, many public and private health care payors limit reimbursement and coverage to the uses of a drug that are either approved by the FDA or that are supported by other appropriate evidence (for example, published medical literature) and appear in a recognized drug compendium. Drug compendia are publications that summarize the available medical evidence for particular drug products and identify which uses of a drug are supported or not supported by the available evidence, whether or not such uses have been approved by the FDA.

Intellectual Property

We strive to protect the proprietary technology that we believe is important to our business, including seeking and maintaining patents intended to cover our product candidates and compositions, and their methods of use and other inventions that are commercially important to the development of our business. We also rely on trade secrets to protect aspects of our business that are not amenable to, or that we do not consider appropriate for, patent protection.

15

As of March 1, 2018, we are the owner of 8 issued U.S. patents and 118 issued non-U.S. patents with claims to novel compounds, compositions containing them, processes for their preparation, and their uses as pharmaceutical agents, with terms expiring between 2019 and 2036. Of these patents, one U.S. patent relates to SCY-078. We are actively pursuing four U.S. patent applications and 22 non-U.S. patent applications in at least 19 jurisdictions.

Our success will depend significantly on our ability to obtain and maintain patents and other proprietary protection for commercially important technology, inventions and know-how related to our business, defend and enforce our patents, maintain our licenses to use intellectual property owned by third parties, preserve the confidentiality of our trade secrets and operate without infringing the valid and enforceable patents and other proprietary rights of third parties. We also rely on know-how, continuing technological innovation and in-licensing opportunities to develop, strengthen, and maintain our proprietary position in the field of antifungal agents.

We believe that we have a strong intellectual property position and substantial know-how relating to the development and commercialization of SCY-078, including patents or patent applications covering inventions that we have co-invented with Merck. We cannot be sure that patents will be granted with respect to any of our pending patent applications or with respect to any patent applications filed by us in the future, nor can we be sure that any of our existing patents or any patents that may be granted to us in the future will be commercially useful in protecting our technology.

Our objective is to continue to expand our intellectual property estate by filing patent applications directed to SCY-078 or derivatives thereof. We intend to pursue, maintain, and defend patent rights, whether developed internally or licensed from third parties, and to protect the technology, inventions, and improvements that are commercially important to the development of our business.

SCY-078

The patent portfolio for SCY-078 is directed to cover compositions of matter, formulation, methods of use and precursors or intermediaries in its preparation. This patent portfolio includes an issued U.S. patent and corresponding foreign national and regional counterpart patents and patent applications. The patents and patent applications relating to SCY-078 include patents and patent applications that were initially assigned to us and Merck Sharp & Dohme Corp, a subsidiary of Merck & Co., Inc. Merck Sharp & Dohme Corp. subsequently assigned to us all of its rights in these patents and patent applications relating to SCY-078. The issued composition of matter patent (U.S. Patent No. 8,188,085), if the appropriate maintenance, renewal, annuity, and other governmental fees are paid, is expected to expire in 2030. Based on our current development plan, we believe that an additional term of up to five years for the SCY-078 U.S. patent may result from the patent term extension provision of the Drug Price Competition and Patent Term Restoration Act of 1984 (the Hatch-Waxman Act). We expect that the patent applications in this portfolio, if issued, and if appropriate maintenance, renewal, annuity, and other governmental fees are paid, would expire between 2030 and 2036, including any additional term from patent term adjustment or patent term extension. The patent term calculation method and the provisions under the Hatch-Waxman Act are described in the “Patent Term” section below. We are not currently aware of any third-party patents (other than patents we have licensed) encompassing SCY-078.

The terms of issued SCY-078 composition of matter patents in other jurisdictions (Algeria, Armenia, Australia, Azerbaijan, Belarus, Belize, Brunei, Canada, China, Colombia, El Salvador, EPO (Austria, Belgium, Croatia, Czech Republic, Denmark, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Luxembourg, Macedonia, Netherlands, Poland, Portugal, Serbia, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, Turkey, United Kingdom), Hong Kong, Honduras, Indonesia, Israel, Japan, Kyrgyzstan, Korea, Kazakhstan, Lebanon, Morocco, Moldova, Mexico, Mexico, Malaysia, Nicaragua, New Zealand, Peru, Philippines, Russia, Singapore, South Africa, Tajikistan, Turkmenistan, Tunisia, Taiwan and Ukraine), if the appropriate maintenance, renewal, annuity, and other government fees are paid, are expected to expire in 2029. These patents and patent applications (if applicable), depending on the national laws, may benefit from extension of patent term in individual countries. In some European countries, for example, a supplementary protection certificate, if obtained, provides a maximum of five years of market exclusivity. The duration of the supplementary protection certificate may be extended to five and a half years when the supplementary protection certificate relates to a human medicinal product for which data from clinical trials conducted in accordance with an agreed Pediatric Investigation Plan, or PIP, have been submitted. Likewise, in Japan, the term of a patent may be extended by a maximum of five years in certain circumstances.

Patent Term

The term of individual patents and patent applications will depend upon the legal term of the patents in the countries in which they are obtained. Generally, the patent term is 20 years from the date of filing of the patent application (or earliest filed parent application, if applicable).

Under the Hatch-Waxman Act, the term of a patent that claims an FDA-approved drug may also be eligible for patent term extension, or PTE. Eligibility for a PTE is based, in part, on whether the FDA approval of the drug represents the first permitted commercial marketing or use of the drug. Drugs that are considered to be new chemical entities under FDA’s regulations are generally eligible for PTE.

16

PTE permits patent term restoration of a U.S. patent as partial compensation for patent term lost during the FDA regulatory review process, which includes both the testing period while the drug is being investigated under an IND and the approval period while FDA is reviewing a marketing application. The length of the patent term extension is half the testing period plus all of the approval period, with certain limitations. The Hatch-Waxman Act permits a patent term extension of up to five years beyond the expiration of the patent; however, a patent term extension cannot in any event extend the remaining term of a patent beyond a total of 14 years from the date of product approval; only one patent that claims an approved drug may be extended; and the applicable approval must be the first approval of the product under the provision of law authorizing the approval. During the extension period, the patent holder’s rights under the patent are generally limited to approved uses of the product. Similar provisions may be available in Europe and certain other foreign jurisdictions to extend the term of a patent that covers an approved drug. When possible, depending upon the length of clinical trials and other factors involved in the filing of an NDA, we expect to apply for patent term extensions for patents covering SCY-078 and its use in treating various diseases. As a specific example, if we are awarded the maximum length of PTE, our U.S. composition of matter patent relating to SCY-078 would have an expected expiration date of the earlier of 14 years from product approval or August 28, 2035. However, depending on any changes in our clinical path and the date of FDA approval, the PTE may not be granted, or may be less than the maximum.

Proprietary rights and processes