SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | |||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| ¨ | Definitive Additional Materials | |||

| ¨ | Soliciting Material Pursuant to § 240.14a-12 | |||

| SCYNEXIS, Inc. (Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box) | ||||

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1. | Title of each class of securities to which transaction applies:

| |||

| 2. | Aggregate number of securities to which transaction applies:

| |||

| 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| 4. | Proposed maximum aggregate value of transaction:

| |||

| 5. | Total fee paid:

| |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 6. | Amount Previously Paid:

| |||

| 7. | Form, Schedule or Registration Statement No.:

| |||

| 8. | Filing Party:

| |||

| 9. | Date Filed:

| |||

SCYNEXIS, INC.

3501-C Tricenter Boulevard

Durham, North Carolina

(919) 544-8600

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On September 11, 2014

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders of SCYNEXIS, Inc., a Delaware corporation. The meeting will be held on Thursday, September 11, 2014, at 9:30 a.m. local time at 3501C Tricenter Blvd, Durham, North Carolina for the following purposes:

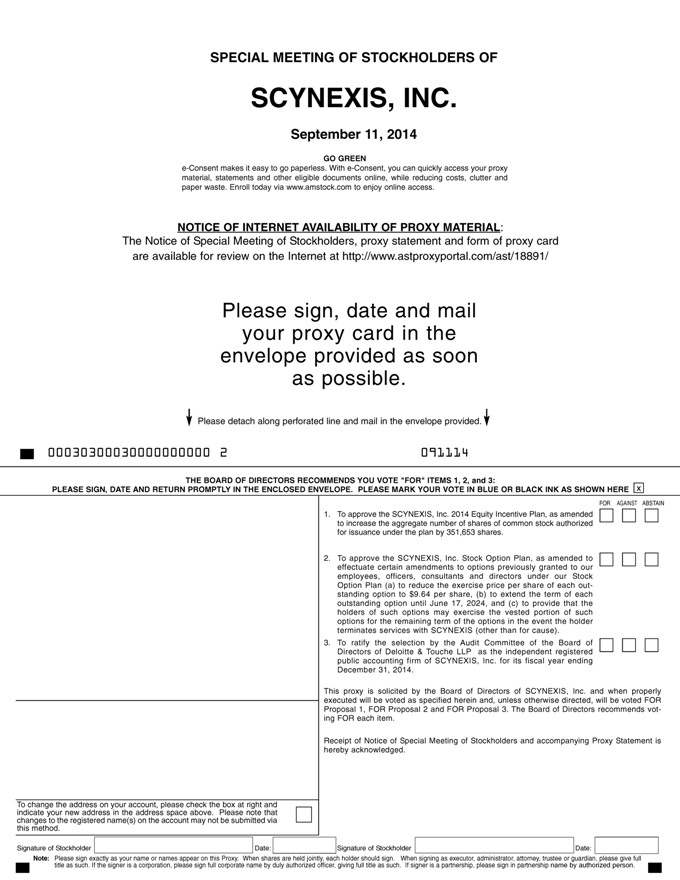

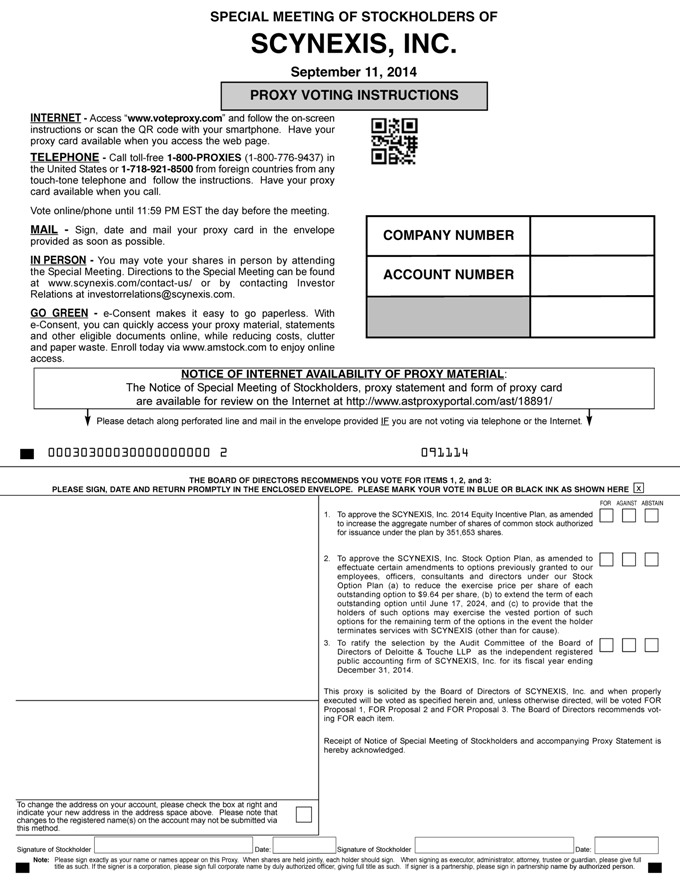

| 1. | To approve the SCYNEXIS, Inc. 2014 Equity Incentive Plan, as amended to increase the aggregate number of shares of common stock authorized for issuance under the plan by 351,653 shares. |

| 2. | To approve the SCYNEXIS, Inc. Stock Option Plan (the “Stock Option Plan”), as amended to effectuate certain amendments to options previously granted to our employees, officers, directors and consultants under our Stock Option Plan (a) to reduce the exercise price per share of each outstanding option to $9.64 per share, (b) to extend the term of each outstanding option until June 17, 2024, and (c) to provide that the holders of such options may exercise the vested portion of such options for the remaining term of the options in the event the holder terminates services with SCYNEXIS (other than for cause). |

| 3. | To ratify the selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as the independent registered public accounting firm of SCYNEXIS for its fiscal year ending December 31, 2014. |

These items of business are more fully described in the Proxy Statement accompanying this Notice.

The record date for the Special Meeting is July 25, 2014. Only stockholders of record at the close of business on that date may vote at the meeting or any adjournment thereof.

Important Notice Regarding the Availability of Proxy Materials for the Stockholders’ Meeting to Be Held on

September 11, 2014, at 9:30 a.m. local time at 3501C Tricenter Blvd, Durham, NC.

The proxy statement is available at http://www.astproxyportal.com/ast/18891/.

By Order of the Board of Directors

/s/ Eileen C. Pruette

Eileen C. Pruette

Secretary

Durham, North Carolina

August 1, 2014

You are cordially invited to attend the Special Meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the proxy mailed to you, or vote over the telephone or the internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

SCYNEXIS, Inc.

3501-C Tricenter Boulevard

Durham, North Carolina, 27713

(919) 544-8600

PROXY STATEMENT

FOR A SPECIAL MEETING OF STOCKHOLDERS

September 11, 2014

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receive a notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you a Notice of Internet Availability of Proxy Materials (the “Notice”) because the Board of Directors of SCYNEXIS, Inc. (“SCYNEXIS”) is soliciting your proxy to vote at the SCYNEXIS Special Meeting of Stockholders, including at any adjournments or postponements of the meeting. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about August 1, 2014, to all stockholders of record entitled to vote at the Special Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after August 11, 2014.

How do I attend the Special Meeting?

The meeting will be held on Thursday, September 11, 2014, at 9:30 a.m. local time at our offices at 3501C Tricenter Blvd, Durham, NC. Directions to the Special Meeting may be found at http://www.astproxyportal.com/ast/18891/. Information on how to vote in person at the Special Meeting is discussed below.

Who can vote at the Special Meeting?

Only stockholders of record at the close of business on July 25, 2014, will be entitled to vote at the Special Meeting. On this record date, there were 8,502,055 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on July 25, 2014, your shares were registered directly in your name with SCYNEXIS’s transfer agent, American Stock Transfer & Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person at the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card or vote by proxy over the telephone or on the internet as instructed below or in your Notice to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on July 25, 2014, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the special meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the special meeting. However, since you are not the stockholder of record, you may not vote your shares in person at the meeting unless you request and obtain a valid proxy from your broker or other agent.

What am I voting on?

There are three matters scheduled for a vote:

| • | Approval of the SCYNEXIS, Inc. 2014 Equity Incentive Plan, as amended to increase the aggregate number of shares of common stock authorized for issuance under the plan by 351,653 shares; |

| • | Approval of the SCYNEXIS, Inc. Stock Option Plan (the “Stock Option Plan”), as amended to effectuate certain amendments to options previously granted to our employees, officers, directors and consultants under our Stock Option Plan (a) to reduce the exercise price per share of each outstanding option to $9.64 per share, (b) to extend the term of each outstanding option until June 17, 2024 and (c) to provide that the holders of such options may exercise the vested portion of such options for the remaining term of the options in the event the holder terminates services with SCYNEXIS (other than for cause); and |

| • | Ratification of selection by the Audit Committee of the Board of Directors of Deloitte & Touche LLP as independent registered public accounting firm of SCYNEXIS for its fiscal year ending December 31, 2014. |

What if another matter is properly brought before the meeting?

The Board of Directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How do I vote?

You may either vote “For” or “Against” or abstain from voting on all the matters to be voted on at the Special Meeting.

The procedures for voting are fairly simple:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Special Meeting, vote by proxy over the telephone, vote by proxy through the internet or vote by proxy using a proxy card that you may request or that we may elect to deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

| • | To vote in person, come to the Special Meeting and we will give you a ballot when you arrive. |

| • | To vote using the proxy card, simply complete, sign and date the proxy card that may be delivered and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, we will vote your shares as you direct. |

| • | To vote over the telephone, dial toll-free 1-800-776-9437 (1-718-921-8500 international) using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice. Your telephone vote must be received by 11:59 p.m., Eastern Time on September 10, 2014, to be counted. |

| • | To vote through the internet, go to http://www.astproxyportal.com/ast/18891/ to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m. Eastern Time on September 10, 2014, to be counted. |

2

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from SCYNEXIS. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Special Meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

Internet proxy voting may be provided to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of July 25, 2014.

What happens if I do not vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record and do not vote by completing your proxy card, by telephone, through the internet or in person at the Special Meeting, your shares will not be voted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (“NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. Accordingly, your broker or nominee may not vote your shares on Proposals 1, and 2 without your instructions, but may vote your shares on Proposal 3.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, (1) “For” the approval of the SCYNEXIS, Inc. 2014 Equity Incentive Plan, as amended to increase the aggregate number of shares of common stock authorized for issuance under the plan by 351,653 shares, (2) “For” the approval of our Stock Option Plan, as amended to effectuate certain amendments to outstanding options granted under our Stock Option Plan to reduce the exercise price per share of each option, to extend the term of each outstanding option until June 17, 2024, and to provide that holders may exercise the vested portion of such options for the remaining term of the option if the holder terminates services with SCYNEXIS (other than for cause), and (3) “For” the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2014.

3

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on the Notices to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy?

Stockholder of Record: Shares Registered in Your Name

Yes. You can revoke your proxy at any time before the final vote at the Special Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of the following ways:

| • | You may submit another properly completed proxy card with a later date. |

| • | You may grant a subsequent proxy by telephone or through the internet. |

| • | You may send a timely written notice that you are revoking your proxy to SCYNEXIS’s Secretary at 3501-C Tricenter Boulevard, Durham, North Carolina 27713. |

| • | You may attend the Special Meeting and vote in person. Simply attending the meeting will not, by itself, revoke your proxy. |

Your most current proxy card or telephone or internet proxy is the one that is counted.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals and director nominations due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing to SCYNEXIS’s Secretary at 3501-C Tricenter Boulevard, Durham, North Carolina 27713, at a reasonable time in advance of the time we begin to print and distribute proxy materials. If you wish to submit a proposal (including a director nomination) at the meeting that is not to be included in next year’s proxy materials, you must do so not earlier than the close of business on the one hundred twentieth (120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (90th) day prior to such annual meeting or the tenth (10th) day following the day on which public announcement of the date of such meeting is first made. Nominations for director for inclusion in next year’s proxy materials must comply with the requirements of Section 5 of SCYNEXIS’s Bylaws.

How are votes counted?

Votes will be counted by the inspector of elections appointed for the Special Meeting, who will separately count votes “For” and “Against,” abstentions and, if applicable, broker non-votes. Abstentions will be counted towards the vote total for each of Proposals 1, 2 and 3, and will have the same effect as “Against” votes. Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

4

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed by the NYSE to be “non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

How many votes are needed to approve each proposal?

| • | To be approved, Proposal No. 1, to approve the SCYNEXIS, Inc. 2014 Equity Incentive Plan, as amended to increase the aggregate number of shares of common stock authorized for issuance under the plan by 351,653 shares, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you mark your proxy to “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| • | To be approved, Proposal No. 2, to approve the Stock Option Plan, as amended to effectuate certain amendments to options previously granted to our employees, officers, directors and consultants under our Stock Option Plan (a) to reduce the exercise price per share of each outstanding option to $9.64 per share, (b) to extend the term of each outstanding option until June 17, 2024, and (c) to provide that the holders of such options may exercise the vested portion of the options for the remaining term of the option in the event the holder terminates services with SCYNEXIS (other than for cause), must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you mark your proxy to “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect. |

| • | To be approved, Proposal No. 3, ratification of the selection of Deloitte & Touche LLP as SCYNEXIS’s independent registered public accounting firm for its fiscal year ending December 31, 2014, must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote on the matter. If you mark your proxy to “Abstain” from voting, it will have the same effect as an “Against” vote. As this is a routine matter, we do not expect that there will be any broker non-votes. |

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the meeting in person or represented by proxy. On the record date, there were 8,502,055 shares outstanding and entitled to vote. Thus, the holders of 4,251,028 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the special meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

5

PROPOSAL NO. 1

APPROVAL OF SCYNEXIS, INC. 2014 EQUITY INCENTIVE PLAN, AS AMENDED

INTRODUCTION

On June 18, 2014, our Board of Directors and our Compensation Committee approved the 2014 Equity Incentive Plan, or the 2014 Plan, subject to stockholder approval, as amended to increase the aggregate number of shares of our common stock that may be issued pursuant to awards under the 2014 Plan by an additional 351,653 shares. All other material terms of the 2014 Plan otherwise remain unchanged.

On June 18, 2014, our Board of Directors also approved, contingent upon stockholder approval of the additional 351,653 shares to be added to the share reserve under the 2014 Plan:

| • | the grant of options to purchase 187,052, 57,420, and 25,230 shares of our common stock at a per share exercise price of $9.64 to each of Yves J. Ribeill, Charles F. Osborne, Jr., and Eileen Pruette, respectively; and |

| • | the grant of options to purchase an aggregate of 126,871 shares of our common stock at a per share exercise price of $9.64 to certain other executive officers and employees. |

Accordingly, in this Proposal No. 1, we are requesting stockholder approval of the 2014 Plan, as amended, or the Amended 2014 Plan, to increase the aggregate number of shares of our common stock reserved for issuance under the Amended 2014 Plan by 351,653 shares, from 260,352 shares to 612,005 shares, as such number may be increased by (1) any shares subject to outstanding options previously granted under our 2009 Stock Option Plan that expire or terminate prior to the exercise or settlement, are forfeited or reacquired prior to vesting, or are otherwise reacquired or withheld to satisfy a tax withholding obligation, referred to as Returning Shares, and (2) an automatic increase to our share reserve to occur on each January 1, commencing on January 1, 2015, and ending on (and including), January 1, 2024, referred to as our Annual Increase, as further described below.

The Amended 2014 Plan will become effective immediately upon stockholder approval of this Proposal No. 1. If such approval is not received, the Amended 2014 Plan will not become effective and the options approved by our Board of Directors contingent upon stockholder approval will not be ratified and will be deemed null and void.

BACKGROUND

In February 2014, our Board of Directors adopted and our stockholders approved, the existing 2014 Plan. The 2014 Plan came into existence on February 11, 2014, or the Adoption Date, but no awards were allowed to be granted under the 2014 Plan until May 2, 2014, or the Effective Date (which was the date of the underwriting agreement between us and the underwriters managing our initial public offering).

At the time our Board of Directors approved our 2014 Plan, it was believed that the shares of our common stock reserved for issuance under the 2014 Plan would allow us to provide adequate equity compensation to current and future employees based on internal forecasts, including our anticipated growth rates, for the foreseeable future. However, in connection with and prior to our initial public offering in May 2014, we effected a 1 for 4.0 reverse split of our common stock on March 17, 2014, and a 1 for 5.1 reverse split of our common stock on April 25, 2014, or our reverse stock splits. As a result, on the Effective Date, the initial maximum number of shares of our common stock issuable pursuant to awards under the 2014 Plan, after giving effect to these reverse stock splits was 260,352 shares, as such number may be increased by the Returning Shares and the Annual Increase, which was significantly lower than the number of shares we had reserved for issuance under the 2014 Plan on the Adoption Date.

6

Our Compensation Committee believes that our ability to provide equity compensation has been, and will continue to be, vital to our ability to attract and retain highly qualified and skilled employees. Accordingly, our Compensation Committee has determined that increasing the aggregate number of shares of our common stock reserved for issuance under the 2014 Plan by 351,653 shares would be appropriate to facilitate the continued growth of our business by enabling us to continue to attract, retain and provide incentives to employees through the grant of equity compensation awards for the foreseeable future.

As of July 25, 2014, options to purchase 440,722 shares of our common stock granted pursuant to our 2014 Plan were outstanding, including 396,573 shares of our common stock subject to the grant of options contingent upon stockholder approval of this Proposal No. 1, or the contingent options, and no shares of our common stock had been issued pursuant to the exercise of options under our 2014 Plan. As of July 25, 2014, the outstanding options granted pursuant to our 2014 Plan had a weighted average exercise price of approximately $9.54 per share. As of July 25, 2014, the closing price of our common stock as reported on The NASDAQ Global Market was $7.09 per share.

If this Proposal No. 1 is approved by our stockholders, the Amended 2014 Plan will become effective on the date of the Special Meeting. In the event our stockholders do not approve this Proposal No. 1, the 2014 Plan will continue in its current form, and the aggregate maximum number of shares of our common stock that may be issued pursuant to awards under the 2014 Plan will be 260,352 shares, as such number may be increased by the Returning Shares and the Annual Increase, and the contingent option grants to certain of our executive officers and employees to purchase an aggregate of 396,573 shares or our common stock will not be ratified.

Overhang

As of July 25, 2014, excluding the contingent options, we had approximately 485,430 shares of our common stock subject to outstanding awards or available for future awards under our equity compensation plans, which represented approximately 5.4% of our fully diluted common shares outstanding (including all outstanding shares of our common stock and all options, excluding the contingent options, issued or reserved for issuance under our equity compensation plans). Such percentage is referred to as the overhang percentage.

| As of July 25, 2014 | ||||

| Total Shares Subject to Outstanding Stock Options under the 2014 Equity Incentive Plan, the 2009 Stock Option Plan and the Stock Option Plan |

221,433 | |||

| Total Stock Options Exercised under the 2014 Equity Incentive Plan |

0 | |||

| Total Fully Diluted Common Shares Outstanding |

8,987,485 | |||

| Weighted-Average Exercise Price Per Share of Outstanding Stock Options (prior to the effectiveness of Proposal No. 2) |

$ | 13.36 | ||

| Total Shares of Common Stock Available for Future Grant under the 2014 Equity Incentive Plan |

216,203 | |||

| Total Shares of Common Stock Available for Future Grant under the 2014 Employee Stock Purchase Plan |

47,794 | |||

| Total Shares of Common Stock Available for Future Grant under the 2009 Stock Option Plan |

0 | |||

| Total Shares of Common Stock Available for Future Grant under the Stock Option Plan |

0 | |||

| Closing Price of Common Stock as Reported on the NASDAQ Global Market on July 25, 2014 |

$ | 7.09 | ||

The 351,653 additional common shares proposed to be included in the Amended 2014 Plan reserve would increase the overhang percentage by an additional 3.6%, to a total overhang of 9.0%, assuming this Proposal No. 1 is approved by our stockholders.

7

Historical Annual Share Usage

The annual share usage under our equity compensation plans for fiscal years 2012 and 2013 is set forth below.

| Fiscal Year 2012(1) |

Fiscal Year 2013(1) |

|||||||

| A: Total Shares Granted Pursuant to Options(2) |

19,859 | 11,525 | ||||||

| B: Basic Weighted Average Common Shares Outstanding(3) |

1,253,704 | 2,135,156 | ||||||

| C: Burn Rate (A / B) |

1.6 | % | 0.5 | % | ||||

| (1) | Share numbers are adjusted for our reverse stock splits. |

| (2) | Represent awards granted under our 2009 Stock Option Plan. |

| (3) | Includes weighted average common stock outstanding for the periods set forth above, on a common stock equivalent basis, for our outstanding common stock, convertible preferred stock, and options, as set forth in our final prospectus on Form 424(b) filed with the Securities and Exchange Commission on May 2, 2014 (File No. 333-194192). |

Description of the Amended 2014 Plan

The material features of our Amended 2014 Plan are summarized below. The following description of the Amended 2014 Plan is a summary only and is qualified in its entirety by reference to the text of the Amended 2014 Plan itself, which is attached to this Proxy Statement as Annex A.

Type of Awards; Eligibility

The Amended 2014 Plan provides for the grant of incentive stock options, nonstatutory stock options, stock appreciation rights, restricted stock awards, restricted stock unit awards, performance-vesting stock awards and other forms of stock or stock-based compensation (collectively, stock awards), all of which may be granted to our approximately 90 eligible employees, seven eligible non-employee directors and two eligible consultants. Incentive stock options may be granted only to our employees. All other awards may be granted to employees and to non-employee directors and consultants.

Shares Available; Certain Limitations

The aggregate number of shares of our common stock that may be issued pursuant to stock awards under the Amended 2014 Plan will be equal to 612,005 shares, which is the sum of (i) 351,653 new shares, and (ii) 260,352 shares previously reserved for issuance. Additionally, the number of shares will be increased by (A) any Returning Shares and (B) any Annual Increase. Under the Annual Increase, the number of shares of our common stock reserved for issuance under the Amended 2014 Plan will automatically increase on January 1 of each year, beginning on January 1, 2015, and continuing through and including January 1, 2024, by 4.0% of the total number of shares of our capital stock outstanding on December 31 of the preceding calendar year, or a lesser number of shares as determined by our Board of Directors. The maximum number of shares that may be issued upon the exercise of incentive stock options under our Amended 2014 Plan is 3,676,470 shares.

The maximum number of shares of our common stock subject to stock awards granted during a single fiscal year to any non-employee director, taken together with any cash fees paid to such non-employee director during the fiscal year, shall not exceed $2,000,000 in total value (calculating the value of any such stock awards based on the grant date fair value of such stock awards for financial reporting purposes and excluding, for this purpose, the value of any dividend equivalent payments paid pursuant to any stock award granted in a previous fiscal year).

8

If a stock award granted under the Amended 2014 Plan expires or otherwise terminates without all of the shares covered by the stock award having been issued, or is settled in cash, the shares of our common stock not acquired pursuant to the stock award again will become available for subsequent issuance under the Amended 2014 Plan. In addition, the following types of shares under the Amended 2014 Plan may become available for the grant of new stock awards under the Amended 2014 Plan: (1) shares that are forfeited to or repurchased by us prior to become fully vested; (2) shares withheld to satisfy income or employment withholding taxes; or (3) shares used to pay the exercise price or purchase price of a stock award. Shares issued under the Amended 2014 Plan may be previously unissued shares or reacquired shares bought by us on the open market or otherwise.

As of July 25, 2014, we have granted stock options to purchase 440,722 shares of our common stock under the 2014 Plan, which includes the grant of stock options to purchase 396,573 shares of our common stock to certain members of our executive management team and employees that were approved by our Board of Directors on June 18, 2014, contingent upon stockholder approval of this Proposal No. 1.

Administration

Our board of directors, or a duly authorized committee of our Board of Directors, has the authority to administer the Amended 2014 Plan as the plan administrator. Our Board of Directors may also delegate to one or more of our officers the authority to (1) designate employees (other than other officers) to be recipients of certain stock awards and (2) determine the number of shares of common stock to be subject to such stock awards. Subject to the terms of the Amended 2014 Plan, our Board of Directors or the authorized committee, referred to herein as the plan administrator, determines recipients, dates of grant, the numbers and types of stock awards to be granted and the terms and conditions of the stock awards, including the period of their exercisability and the vesting schedule applicable to a stock award. Subject to the limitations set forth below, the plan administrator will also determine the exercise price, strike price or purchase price of awards granted and the types of consideration to be paid for the award.

The plan administrator has the authority to modify outstanding awards under the Amended 2014 Plan. Subject to the terms of our Amended 2014 Plan, the plan administrator has the authority to reduce the exercise, purchase or strike price of any outstanding stock award, cancel any outstanding stock award in exchange for new stock awards, cash or other consideration, or take any other action that is treated as a repricing under generally accepted accounting principles, with the consent of any adversely affected participant.

Option Awards

Incentive stock options and nonstatutory stock options are granted pursuant to stock option agreements adopted by the plan administrator. The plan administrator determines the exercise price for stock options, within the terms and conditions of the Amended 2014 Plan, provided that the exercise price of a stock option generally cannot be less than 100% of the fair market value of our common stock on the date of grant. Options granted under the Amended 2014 Plan vest at the rate specified by the plan administrator.

The plan administrator determines the term of stock options granted under the Amended 2014 Plan, which term may be for a maximum of 10 years (or five years, if an incentive stock option granted to a ten percent stockholder). Unless the terms of the option holder’s stock option agreement provide otherwise, if an option holder’s service relationship with us, or any of our affiliates, ceases for any reason other than disability, death or cause, the option holder may generally exercise any vested options for a period of three months following the option holder’s cessation of service. The option term may be extended in the event that exercise of the option or sale of the underlying shares following such a termination of service is prohibited by applicable securities laws or by our insider trading policy. If an option holder’s service relationship with us or any of our affiliates ceases due to disability or death, or an option holder dies within a specified period following cessation of service, the option holder or a beneficiary may generally exercise any vested options for a period of twelve months in the event of disability and 18 months in the event of death. In the event of a termination for cause, options generally terminate immediately upon the event giving rise to the termination of the individual’s service for cause. In no event may an option be exercised beyond the expiration of its term.

9

Acceptable consideration for the purchase of common stock issued upon the exercise of a stock option will be determined by the plan administrator and may include the following methods: (1) cash, check, bank draft or money order; (2) a broker-assisted cashless exercise procedure; (3) the tender of shares of our common stock previously owned by the option holder; (4) if the option is a nonstatutory stock option, by a net exercise arrangement; and (5) other legal consideration approved by the plan administrator and set forth in the applicable award agreement.

Unless the plan administrator provides otherwise, options generally are not transferable except by will, the laws of descent and distribution, or pursuant to a domestic relations order. Subject to approval, an option holder may designate a beneficiary, however, who may exercise the option following the option holder’s death.

Tax Limitations on Incentive Stock Options

The aggregate fair market value, determined at the time of grant, of our common stock with respect to incentive stock options that are exercisable for the first time by an option holder during any calendar year under all of our stock plans may not exceed $100,000. Options or portions thereof that exceed such limit will generally be treated as nonstatutory stock options. No incentive stock option may be granted to any person who, at the time of grant, owns or is deemed to own stock possessing more than 10% of our total combined voting power or that of any of our affiliates unless (1) the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant and (2) the term of the incentive stock option does not exceed five years from the date of grant.

Other Awards

Restricted Stock Unit Awards. Restricted stock unit awards are granted pursuant to restricted stock unit award agreements adopted by the plan administrator. Restricted stock unit awards may be granted in consideration for any form of legal consideration. A restricted stock unit award may be settled by cash, delivery of stock, a combination of cash and stock as deemed appropriate by the plan administrator, or in any other form of consideration set forth in the restricted stock unit award agreement. Additionally, dividend equivalents may be credited in respect of shares covered by a restricted stock unit award. Except as otherwise provided in the applicable award agreement, restricted stock units that have not vested will be forfeited upon the participant’s cessation of continuous service for any reason.

Restricted Stock Awards. Restricted stock awards are granted pursuant to restricted stock award agreements adopted by the plan administrator. A restricted stock award may be awarded in consideration for cash, check, bank draft or money order, past services to us, or any other form of legal consideration that may be acceptable to our Board of Directors and permissible under applicable law. The plan administrator determines the terms and conditions of restricted stock awards, including vesting and forfeiture restrictions. If a participant’s service relationship with us ceases for any reason, we may receive through a forfeiture condition or a repurchase right any or all of the shares of common stock held by the participant that have not vested as of the date the participant terminates service with us.

Stock Appreciation Rights. Stock appreciation rights are granted pursuant to stock appreciation grant agreements adopted by the plan administrator. The plan administrator determines the purchase price or strike price for a stock appreciation right, which generally cannot be less than 100% of the fair market value of our common stock on the date of grant. Upon the exercise of a stock appreciation right, we will pay the participant an amount equal to the product of (1) the excess, if any, of the per share fair market value of our common stock on the date of exercise over the purchase price or strike price, and (2) the number of shares of common stock with respect to which the stock appreciation right is exercised. This amount may be paid in shares of our common stock, in cash, in any combination of cash and shares of our common stock or in any other form of consideration, as determined by the plan administrator and set forth in the award agreement. A stock appreciation right granted under the Amended 2014 Plan vests at the rate specified in the stock appreciation right agreement as determined by the plan administrator.

10

The plan administrator determines the term of stock appreciation rights granted under the Amended 2014 Plan, which may be up to a maximum of 10 years. Unless the terms of a participant’s stock appreciation right agreement provides otherwise, if a participant’s service relationship with us or any of our affiliates ceases for any reason other than cause, disability or death, the participant may generally exercise any vested stock appreciation right for a period of three months following the cessation of service. The term of the stock appreciation right may be further extended in the event that exercise of the stock appreciation right following such a termination of service is prohibited by applicable securities laws or by our insider trading policy. If a participant’s service relationship with us, or any of our affiliates, ceases due to disability or death, or a participant dies within a certain period following cessation of service, the participant (or, if applicable, a beneficiary) may generally exercise any vested stock appreciation right for a period of twelve months in the event of disability and 18 months in the event of death. In the event of a termination for cause, stock appreciation rights generally terminate immediately upon the occurrence of the event giving rise to the termination of the individual’s service for cause. In no event may a stock appreciation right be exercised beyond the expiration of its term.

Other Stock Awards. The plan administrator may grant other awards based in whole or in part by reference to our common stock. The plan administrator will set the number of shares under the stock award and all other terms and conditions of such awards.

Restrictions on Transfer

Awards generally are not transferable except by will or by the laws of descent and distribution or as otherwise may be permitted under the Amended 2014 Plan. Options are exercisable during the lifetime of a participant only by the participant.

Clawback/Recovery

Awards granted under the Amended 2014 Plan will be subject to recoupment in accordance with any clawback policy that we are required to adopt pursuant to the listing standards of any national securities exchange or association on which our securities are listed or as is otherwise required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. In addition, the Board of Directors may impose such other clawback, recovery or recoupment provisions in an award agreement as the Board of Directors determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired shares of our common stock or other cash or property upon an event constituting cause.

Changes to Capital Structure

In the event there is a specified type of change in our capital structure, such as a stock split, reverse stock split, or recapitalization, appropriate adjustments will be made to (1) the class and maximum number of shares reserved for issuance under the Amended 2014 Plan, (2) the class and maximum number of shares by which the share reserve may increase automatically each year, (3) the class and maximum number of shares that may be issued upon the exercise of incentive stock options, (4) the class and maximum number of shares subject to stock awards that can be granted in a calendar year, and (5) the class and number of shares and exercise price, strike price, or purchase price, if applicable, of all outstanding stock awards.

Corporate Transaction

Unless otherwise provided in an award agreement or any other written agreement between us and a participant, in the event of a corporate transaction, the plan administrator will take any one or more of the following actions with respect to outstanding stock awards, contingent upon the closing of the corporate transaction:

| • | arrange for the surviving corporation or acquiring corporation (or its parent) to assume or continue outstanding stock awards or substitute a similar award for such stock award; |

11

| • | arrange for the assignment or lapse of any reacquisition or repurchase rights; |

| • | accelerate the vesting, in whole or in part, of stock awards to a date prior to the effective time of a corporate transaction, with such stock award terminating if not exercised (if applicable) at or prior to the effective time of such corporate transaction; |

| • | cancel or arrange for the cancellation of the stock award, to the extent not vested or not exercised prior to the effective time of a corporate transaction, in exchange for a payment, in such form as determined by the plan administrator, equal to the excess (if any) of the value of the property the participant would have received upon exercise of the stock award immediately prior to the effective time of the corporate transaction over any exercise price payable by the participant in connection with the exercise. |

The plan administrator need not take the same action or actions with respect to all stock awards or portions thereof or with respect to all participants.

Under the Amended 2014 Plan, a corporate transaction generally occurs upon the consummation of: (1) a sale or other disposition of all or substantially all of our assets; (2) a sale or other disposition of at least 90% of our outstanding securities; (3) a merger, consolidation or similar transaction following which we are not the surviving corporation; or (4) a merger, consolidation or similar transaction following which we are the surviving corporation but the shares of our common stock outstanding immediately prior to the transaction are converted or exchanged into other property by virtue of the transaction.

Changes in Control

The plan administrator may provide, in an individual award agreement or in any other written agreement between a participant and us that the stock award will be subject to additional acceleration of vesting and exercisability in the event of a change of control. Under the Amended 2014 Plan, a change of control generally occurs upon: (1) the acquisition by a person or entity of more than 50% of our combined voting power, other than by merger, consolidation or similar transaction (and excluding the acquisition of our securities by certain individuals or affiliates, as set forth in the Amended 2014 Plan); (2) a consummated merger, consolidation or similar transaction immediately after which our stockholders cease to own more than 50% of the combined voting power of the surviving entity; (3) a consummated sale, lease, exclusive license or other disposition of all or substantially all of our consolidated assets; or (4) individuals who constitute our incumbent board of directors cease to constitute at least a majority of our Board of Directors.

Plan Amendments and Termination

Our Board of Directors generally has the authority to amend, suspend or terminate our Amended 2014 Plan at any time, provided that except in specified circumstances, no such action may be taken without such participant’s written consent if it would materially impair the existing rights of any participant. No incentive stock options or any other awards may be granted after February 10, 2024.

U.S. Federal Income Tax Consequences

The following is a summary of certain United States federal income tax consequences of awards under the Amended 2014 Plan. The summary below does not purport to be a complete description of all applicable rules, and those rules (including those summarized her) are subject to change.

Nonstatutory Stock Options

Generally, there is no taxation upon the grant of a nonstatutory stock option if the option is granted with an exercise price equal to or greater than the fair market value of the underlying stock on the grant date. On exercise, a participant will recognize ordinary income equal to the excess, if any, of the fair market value of the stock on the date of exercise over the exercise price. If the options were granted to an individual who was our

12

employee or an employee of an affiliate at the time of grant, that income will be subject to withholding taxes. The participant’s tax basis in those shares will be equal to their fair market value on the date of exercise of the stock option, and the participant’s capital gain holding period for those shares will begin on that date. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Internal Revenue Code of 1986, as amended, or the Internal Revenue Code, and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the participant.

Incentive Stock Options

The Amended 2014 Plan provides for the grant of stock options that qualify as “incentive stock options,” as defined in Section 422 of the Code. Under the Code, a participant generally is not subject to ordinary income tax upon the grant or exercise of an incentive stock option. If the participant holds a share received on exercise of an incentive stock option for more than two years from the date the incentive stock option was granted and more than one year from the date the incentive stock option was exercised, which is referred to as the required holding period, the difference, if any, between the amount realized on a sale or other taxable disposition of that share and the participant’s tax basis in that share will be long-term capital gain or loss.

If, however, a participant disposes of a share acquired on exercise of an incentive stock option before the end of the required holding period, which is referred to as a disqualifying disposition, the participant generally will recognize ordinary income in the year of the disqualifying disposition equal to the excess, if any, of the fair market value of the share on the date the incentive stock option was exercised over the exercise price. However, if the sales proceeds are less than the fair market value of the share on the date of exercise of the incentive stock option, the amount of ordinary income recognized by the participant will not exceed the gain, if any, realized on the sale. If the amount realized on a disqualifying disposition exceeds the fair market value of the share on the date of exercise of the incentive stock option, that excess will be short-term or long-term capital gain, depending on whether the holding period for the share exceeds one year.

For purposes of the alternative minimum tax, the amount by which the fair market value of a share of stock acquired on exercise of an incentive stock option exceeds the exercise price of that stock option generally will be an adjustment included in the participant’s alternative minimum taxable income for the year in which the incentive stock option is exercised. If, however, there is a disqualifying disposition of the share in the year in which the incentive stock option is exercised, there will be no adjustment for alternative minimum tax purposes with respect to that share. In computing alternative minimum taxable income, the tax basis of a share acquired on exercise of an incentive stock option is increased by the amount of the adjustment taken into account with respect to that share for alternative minimum tax purposes in the year the incentive stock option is exercised.

We are not allowed an income tax deduction with respect to the grant or exercise of an incentive stock option or the disposition of a share acquired on exercise of an incentive stock option after the required holding period. If there is a disqualifying disposition of a share, however, we are allowed a deduction in an amount equal to the ordinary income includible in income by the participant, subject to Section 162(m) of the Code and provided that amount constitutes an ordinary and necessary business expense for us and is reasonable in amount, and either the employee includes that amount in income or we timely satisfy our reporting requirements with respect to that amount.

RSU Awards

Generally, the recipient of a restricted stock unit structured to conform to the requirements of Section 409A of the Code or an exception to Section 409A of the Code will recognize ordinary income at the time the stock is delivered equal to the excess, if any, of the fair market value of the shares of our common stock received over any amount paid by the recipient in exchange for the shares of our common stock. If a restricted stock unit is subject to Section 409A of the Code, the shares of our common stock subject to a restricted stock unit award may generally only be delivered upon one of the following events: a fixed calendar date (or dates), separation from service, death, disability or a change in control. If delivery occurs on another date, unless the restricted stock

13

units otherwise comply with or qualify for an exception to the requirements of Section 409A of the Code, in addition to the tax treatment described above, the recipient will owe an additional 20% federal tax and interest on any taxes owed. The recipient’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired upon settlement of restricted stock units will be the amount paid for such shares plus any ordinary income recognized when the stock is delivered. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the restricted stock unit.

Restricted Stock Awards

Generally, the recipient of a restricted stock award will recognize ordinary income at the time the stock is received equal to the excess, if any, of the fair market value of the stock received over any amount paid by the recipient in exchange for the stock. If, however, the stock is restricted and not vested when it is received (for example, if the participant is required to work for a period of time in order to have the right to sell the stock), the recipient generally will not recognize income until the stock becomes vested, at which time the recipient will recognize ordinary income equal to the excess, if any, of the fair market value of the stock on the date it becomes vested over any amount paid by the recipient in exchange for the stock. A recipient may, however, file an election with the Internal Revenue Service, within 30 days following his or her receipt of the restricted stock award, to recognize ordinary income, as of the date the recipient receives the award, equal to the excess, if any, of the fair market value of the stock on the date the award is granted over any amount paid by the recipient for the stock. The recipient’s basis for the determination of gain or loss upon the subsequent disposition of shares acquired from stock awards will be the amount paid for such shares plus any ordinary income recognized either when the stock is received or when the stock becomes vested. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the stock award.

Stock Appreciation Rights

If a stock appreciation right is granted with a strike price equal to the fair market value of the underlying stock on the grant date, the participant will recognize ordinary income equal to the product of (1) the excess, if any, of the per share fair market value of our common stock on the date of exercise over the purchase price or strike price, and (2) the number of shares of common stock with respect to which the stock appreciation right is exercised. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the recipient of the stock appreciation right.

NEW PLAN BENEFITS

Awards under our Amended 2014 Plan are made within the discretion of our Board of Directors and are not subject to set benefits or amounts. Accordingly, we cannot currently determine the benefits or number of shares of our common stock subject to awards that may be granted in the future to executive officers, directors or employees under the Amended 2014 Plan.

14

The following table sets forth, for each of the individuals and groups indicated, the number of shares of our common stock subject to awards granted under our 2014 Plan between May 2, 2014, and July 25, 2014. The information below includes the grants of stock options to purchase 187,052, 57,420, and 25,230 shares of our common stock at a per share exercise price of $9.64 to each of Yves J. Ribeill, Charles F. Osborne, Jr., and Eileen Pruette, respectively, as well as the grants of stock options to purchase an aggregate of 126,871 shares of our common stock at a per share exercise price of $9.64 to certain of our executive officers and employees. The foregoing option grants were approved by our Board of Directors on June 18, 2014, contingent upon stockholder approval of this Proposal No. 1.

| Name and Position |

Number of Shares Subject to Options |

|||

| Yves J. Ribeill, Ph.D. President and Chief Executive Officer |

187,052 | (1) | ||

| Charles F. Osborne, Jr. Chief Financial Officer |

57,420 | (1) | ||

| Eileen C. Pruette General Counsel |

25,230 | (1) | ||

| All Current Executive Officers as a Group |

296,672 | (1) | ||

| All Current Non-Employee Directors as a Group |

35,111 | |||

| All Current Employees as a Group (including all current non-executive officers) |

108,939 | (2) | ||

| (1) | Shares subject to options granted on a contingent basis, subject to stockholder approval of this Proposal No. 1. |

| (2) | Includes options exercisable for 99,901 shares of our common stock on a contingent basis, subject to stockholder approval of this Proposal No. 1. |

REQUIRED VOTE

The affirmative vote of the holders of a majority of the shares of common stock present in person or represented by proxy and entitled to vote at the Special Meeting will be required to approve the Amended 2014 Plan. If you “Abstain” from voting, it will have the same effect as an “Against” vote. Broker non-votes will have no effect.

THE BOARD OF DIRECTORS RECOMMENDS

A VOTE IN FAVOR OF PROPOSAL NO. 1.

15

PROPOSAL NO. 2

APPROVAL OF

THE SCYNEXIS, INC. STOCK OPTION PLAN, AS AMENDED AND RESTATED

TO EFFECTUATE AMENDMENTS TO OUTSTANDING OPTIONS GRANTED UNDER THE

SCYNEXIS, INC. STOCK OPTION PLAN

In this Proposal No. 2, we are requesting stockholder approval of our Stock Option Plan, as amended and restated, to effectuate certain amendments to outstanding options previously granted under the Stock Option Plan. Approval of this Proposal No. 2 by our stockholders will constitute (1) the re-adoption of our Stock Option Plan, as amended and restated, and (2) the approval of the amendments to outstanding options previously granted under the Stock Option Plan, as described below.

INTRODUCTION

On June 18, 2014, our Board of Directors approved, subject to stockholder approval, the Stock Option Plan, as amended and restated, or the Amended 1999 Stock Plan (which was originally adopted by our Board of Directors on November 4, 1999, and was last amended by our Board of Directors on April 23, 2009, and approved by our stockholders on May 28, 2009). Our Board of Directors approved the Amended 1999 Stock Plan to effectuate certain amendments to outstanding options previously granted under the Stock Option Plan, including so that such amended options may, to the greatest extent permitted under applicable law, either qualify or continue to be treated as incentive stock options as a result of such amendments. If the Amended 1999 Stock Plan is approved by our stockholders, other than with respect to the 73,087 shares subject to outstanding options granted under the Amended 1999 Stock Plan as of July 25, 2014, there are no shares reserved for the issuance of awards under the Amended 1999 Stock Plan and no new awards may be granted under the Amended 1999 Stock Plan.

On June 18, 2014, our Board of Directors approved, subject to stockholder approval, certain amendments to outstanding options previously granted under the Stock Option Plan: (i) to reduce the exercise price of such options; (ii) to extend the term of such options for a period of ten years from the date of amendment; and (iii) to permit the holders of such options who terminate service with us (other than for cause) to exercise the vested portion of the amended options for the remaining term of the amended options. In this Proposal No. 2, we refer to these amendments to the outstanding options collectively as the Repricing Amendments.

As further described below, in this Proposal No. 2, we are requesting stockholder approval of the Amended 1999 Stock Plan, which will effectuate the Repricing Amendments. If our stockholders do not approve this Proposal No. 2, the Amended 1999 Stock Plan will not be approved and the outstanding options previously granted under the Stock Option Plan will continue in accordance with their terms as in effect prior to the Repricing Amendments.

| I. | APPROVAL OF THE STOCK OPTION PLAN, AS AMENDED AND RESTATED |

We are requesting stockholder approval of our Stock Option Plan, as amended and restated, or the Amended 1999 Stock Plan, to effectuate the Repricing Amendments (which are described below under the heading “II. REPRICING AMENDMENTS”), including so that after giving effect to such amendments, the amended options may, to the greatest extent permitted under applicable law, either qualify or continue to be treated as incentive stock options. No new awards may be granted under the Amended 1999 Stock Plan and any shares subject to outstanding awards thereunder that are forfeited or cancelled without being exercised will be returned to our Amended 2014 Plan.

As of July 25, 2014, there were 73,087 shares of our common stock issuable upon the exercise of outstanding options under the Stock Option Plan, with a weighted average exercise price of approximately $21.50 per share. As of July 25, 2014, the closing price of our common stock as reported on The NASDAQ Global Market was $7.09 per share.

16

Description of the Amended 1999 Stock Plan

The material features of the Amended 1999 Stock Plan are summarized below. The following description of the Amended 1999 Stock Plan is a summary only and is qualified in its entirety by reference to the text of the Amended 1999 Stock Plan itself, which is attached to this Proxy Statement as Annex B.

Purpose

The purpose of the Amended 1999 Stock Plan is to create an additional incentive for our key employees, directors and consultants to promote our financial success and growth. As described above, we are re-adopting the Amended 1999 Stock Plan solely for the purposes of implementing certain amendments to outstanding options granted thereunder, which amendments are further described below under the heading “II. REPRICING AMENDMENTS”.

Type of Awards; Eligibility

The Amended 1999 Stock Plan provides for the grant of incentive stock options and nonstatutory stock options to our eligible employees, directors and consultants. Incentive stock options may only be granted to our employees. As of July 25, 2014, approximately 90 employees, two consultants and seven non-employee directors held all of the outstanding options under the Stock Option Plan. No new options may be granted under the Stock Option Plan or, if this Proposal No. 2 is approved, the Amended 1999 Stock Plan.

Shares Available

As of July 25, 2014, there were 73,087 shares of our common stock issuable upon the exercise of outstanding options under the Stock Option Plan. No shares of our common stock are reserved for the issuance of new options under our Amended 1999 Stock Plan and no new options may be granted under the Amended 1999 Stock Plan. However, outstanding options previously granted under the Stock Option Plan may be amended and, to the extent amended pursuant to the Repricing Amendments, will be governed by the terms of the Amended 1999 Stock Plan.

If any options previously granted under the Amended 1999 Stock Plan expire or otherwise terminate without all of the shares covered by the option having been issued, or are settled in cash, the shares of our common stock not acquired pursuant to the option would become available for subsequent issuance under the Amended 2014 Plan, which is described in Proposal No. 1 above.

Options granted under the Amended 1999 Stock Plan represent options to purchase shares of our authorized but unissued common stock, as adjusted for certain capitalization adjustments.

Administration

Our Board of Directors, or a duly authorized committee of our Board of Directors, administers outstanding options granted under the Amended 1999 Stock Plan. Our Board of Directors has the authority to vary the terms of forms of option agreements either in connection with the grant of an option or in connection with the authorization of a new form of option agreement; provided, that the terms and conditions of such amendments are in accordance with the terms of the Amended 1999 Stock Plan.

Option Awards

The Amended 1999 Stock Plan provides for the grant of incentive stock options to our eligible employees and nonstatutory stock options to our eligible employees, directors and consultants. Each option must be evidenced by an option award agreement and must be granted with an exercise price determined by our Board of Directors, which, for incentive stock options, is at least 100% of the fair market value of our common stock on

17

the date the option was granted (or at least 110% of the fair market value, if granted to a participant who owns more than 10% of the total combined voting power of all classes of our outstanding stock, or a ten percent stockholder). The term of any option granted under the Amended 1999 Stock Plan is established by our Board of Directors, except that no incentive stock option may be granted with a term greater than ten years after the date of grant (or five years, if granted to a ten percent stockholder).

The aggregate fair market value, determined at the time of grant, of our common stock with respect to incentive stock options that are exercisable for the first time by an option holder during any calendar year under all of our equity compensation plans may not exceed $100,000. Options or portions thereof that exceed such limit will generally be treated as nonstatutory stock options.

Termination of Service

Unless otherwise provided in an option award agreement or any amendment thereto, an option will terminate and cease to be exercisable no later than three months after the date on which an option holder terminates employment or service with us, except that if an option holder’s employment or service terminates due to death (including, if the option holder dies within three months following the option holder’s termination of employment) or disability, then such option will terminate and cease to be exercisable no later than twelve months from the date of the option holder’s death or disability. Notwithstanding the foregoing, no option may be exercised after the date the option holder’s employment with us is terminated for cause (as determined in the sole discretion of our Board of Directors).

Payment of Option Exercise Price

Acceptable consideration for the purchase of common stock issued upon the exercise of a stock option will be made in cash, by check, cash equivalent or in any other form as may be permitted by our Board of Directors, in its sole discretion.

Capitalization Adjustments

In the event of a stock dividend, stock split, reverse stock split, combination, reclassification or like changes in our capital structure, our Board of Directors will make appropriate adjustments in the number and class of shares of stock subject to the Amended 1999 Stock Plan and to any outstanding options and the exercise price of any outstanding options.

Transfer of Control

In the event of a transfer of control, any then unexercisable portion of an outstanding option will become immediately exercisable as of a date prior to, but conditioned upon, the transfer of control, determined by our Board of Directors, except to the extent that (1) the option is either to be assumed by, or substituted with a comparable option to purchase shares of, the successor corporation (or parent thereof), (2) the option is to be replaced with a cash incentive program of the successor corporation which preserves the spread existing on the unvested option at the time of the transfer of control and provides for subsequent payout in accordance with the same vesting schedule applicable to the option, or (3) the acceleration of the option is subject to other limitations imposed by our Board of Directors at the time the option was granted. Our Board of Directors may provide that any options which become exercisable solely by reason of these provisions and remain unexercised will terminate effective as of the date of the transfer of control. For purposes of the Amended 1999 Stock Plan, a transfer of control means a merger, consolidation, corporate reorganization, or sale or transfer of substantially all of our assets or stock (other than a reincorporation transaction or one in which the holders of our capital stock immediately prior to the merger or consolidation continue to hold at least a majority of the voting power of the surviving corporation).

18

Transferability

No option may be assignable or transferable by an option holder, except by will or by the laws of descent and distribution. During the lifetime of an option holder, an option will be exercisable only by the option holder.

Amendment and Termination

Our Board of Directors generally may terminate or amend the Amended 1999 Stock Plan at any time; provided, however, that no amendment may adversely affect any then outstanding option or any unexercised portion thereof, without the consent of the option holder, unless such amendment is required to enable an option designated as an incentive stock option to qualify as an incentive stock option.

U.S. Federal Income Tax Consequences

The following is a summary of certain United States federal income tax consequences of awards under the Amended 1999 Stock Plan. The summary below does not purport to be a complete description of all applicable rules, and those rules (including those summarized here) are subject to change.

Nonstatutory Stock Options

Generally, there is no taxation upon the grant of a nonstatutory stock option if the option is granted with an exercise price equal to or greater than the fair market value of the underlying stock on the grant date. On exercise, a participant will recognize ordinary income equal to the excess, if any, of the fair market value of the stock on the date of exercise over the exercise price. If the options were granted to an individual who was our employee or an employee of an affiliate at the time of grant, that income will be subject to withholding taxes. The participant’s tax basis in those shares will be equal to their fair market value on the date of exercise of the stock option, and the participant’s capital gain holding period for those shares will begin on that date. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, we will generally be entitled to a tax deduction equal to the taxable ordinary income realized by the participant.

Incentive Stock Options

The Amended 1999 Stock Plan provides for the grant of stock options that qualify as “incentive stock options,” as defined in Section 422 of the Code. Under the Code, a participant generally is not subject to ordinary income tax upon the grant or exercise of an incentive stock option. If the participant holds a share received on exercise of an incentive stock option for more than two years from the date the incentive stock option was granted and more than one year from the date the incentive stock option was exercised, which is referred to as the required holding period, the difference, if any, between the amount realized on a sale or other taxable disposition of that share and the participant’s tax basis in that share will be long-term capital gain or loss.

If, however, a participant disposes of a share acquired on exercise of an incentive stock option before the end of the required holding period, which is referred to as a disqualifying disposition, the participant generally will recognize ordinary income in the year of the disqualifying disposition equal to the excess, if any, of the fair market value of the share on the date the incentive stock option was exercised over the exercise price. However, if the sales proceeds are less than the fair market value of the share on the date of exercise of the incentive stock option, the amount of ordinary income recognized by the participant will not exceed the gain, if any, realized on the sale. If the amount realized on a disqualifying disposition exceeds the fair market value of the share on the date of exercise of the incentive stock option, that excess will be short-term or long-term capital gain, depending on whether the holding period for the share exceeds one year.

For purposes of the alternative minimum tax, the amount by which the fair market value of a share of stock acquired on exercise of an incentive stock option exceed the exercise price of that stock option generally will be an adjustment included in the participant’s alternative minimum taxable income for the year in which the

19

incentive stock option is exercised. If, however, there is a disqualifying disposition of the share in the year in which the incentive stock option is exercised, there will be no adjustment for alternative minimum tax purposes with respect to that share. In computing alternative minimum taxable income, the tax basis of a share acquired on exercise of an incentive stock option is increased by the amount of the adjustment taken into account with respect to that share for alternative minimum tax purposes in the year the incentive stock option is exercised.

We are not allowed an income tax deduction with respect to the grant or exercise of an incentive stock option or the disposition of a share acquired on exercise of an incentive stock option after the required holding period. If there is a disqualifying disposition of a share, however, we are allowed a deduction in an amount equal to the ordinary income includible in income by the participant, subject to Section 162(m) of the Code and provided that amount constitutes an ordinary and necessary business expense for us and is reasonable in amount, and either the employee includes that amount in income or we timely satisfy our reporting requirements with respect to that amount.

NEW PLAN BENEFITS

There are no shares reserved for issuance under our Amended 1999 Stock Plan and no new awards may be granted under the Amended 1999 Stock Plan. However, outstanding options previously granted under our Stock Option Plan may be amended and, to the extent amended pursuant to the Repricing Amendments, will be governed by the terms of the Amended 1999 Stock Plan. The following table sets forth, for each of the individuals and groups indicated, the number of shares of our common stock subject to outstanding options through July 25, 2014, that, subject to stockholder approval of this Proposal No. 2, will be governed by the Amended 1999 Stock Plan. Subject to stockholder approval of this Proposal No. 2, the outstanding options set forth in the following table will be amended as described under “II. REPRICING AMENDMENTS” below.

| Name and Position |

Number of Shares Subject to Outstanding Options |

|||

| Yves J. Ribeill, Ph.D. President and Chief Executive Officer |

25,928 | |||

| Charles F. Osborne, Jr. Chief Financial Officer |

5,642 | |||

| Eileen C. Pruette General Counsel |