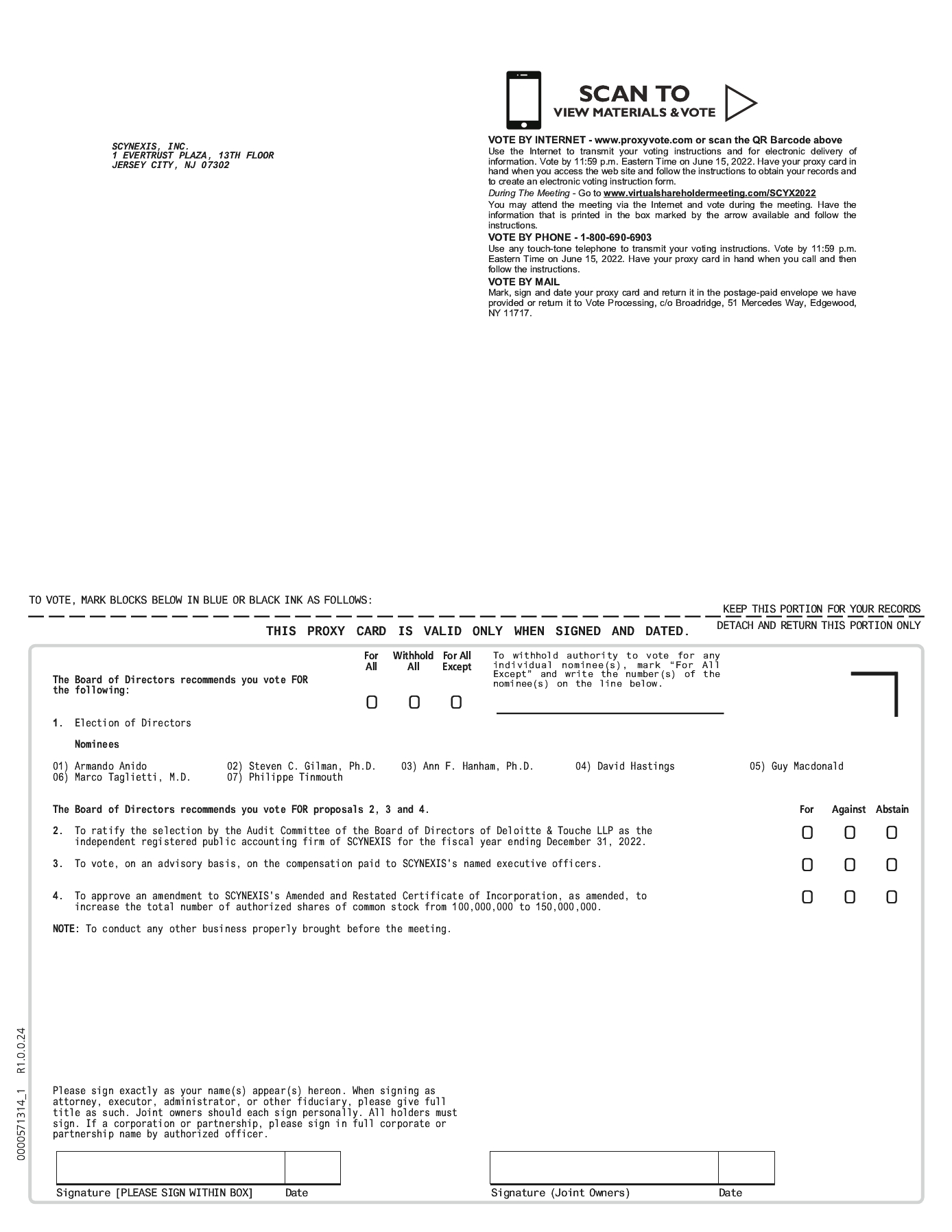

APPROVAL OF AN AMENDMENT TO SCYNEXIS’S AMENDED AND RESTATED CERTIFICATE OF INCORPORATION, AS AMENDED, TO INCREASE THE TOTAL NUMBER OF AUTHORIZED SHARES OF COMMON STOCK FROM 100,000,000 TO 150,000,000

Our Board of Directors has adopted resolutions approving and submitting to a vote of the stockholders an amendment to Article IV of our Amended and Restated Certificate of Incorporation, as amended, to increase the number of authorized shares of common stock from 100,000,000 to 150,000,000.

Our Board of Directors believes that the availability of additional authorized shares of common stock will provide us with the flexibility in the future to issue shares of our common stock (i) for general corporate purposes, including raising additional capital and settling outstanding obligations, (ii) in connection with present and future employee benefit programs and (iii) in connection with expanding our business through acquisitions of companies or assets. We have no plans, arrangements or understandings, whether written or oral, to issue any of the common stock that will be newly available following the approval of this proposal by our stockholders.

Our Board of Directors will determine whether, when and on what terms the issuance of shares of our common stock may be warranted in connection with any future actions. No further action or authorization by our stockholders will be necessary before the issuance of the additional shares of our common stock authorized under our Amended and Restated Certificate of Incorporation, as amended, except as may be required for a particular transaction by applicable law or regulatory agencies or by the rules of any stock market or exchange on which our common stock may then be listed.

Our Amended and Restated Certificate of Incorporation currently authorizes the issuance of 100,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par value $0.001 per share. As of April 27, 2022, there were 32,579,491 shares of common stock outstanding and no shares of preferred stock outstanding. In addition, as of April 27, 2022, 45,379,650 shares of common stock were issuable upon the exercise of outstanding options and warrants and 1,138,200 shares of common stock were reserved for issuance in connection with the conversion of outstanding promissory notes.

The additional common stock proposed to be authorized pursuant to the amendment would have rights identical to the currently outstanding shares of our common stock. Approval of this Proposal 4 would not affect the rights of the holders of currently outstanding shares of our common stock, except for effects incidental to increasing the number of shares of our common stock outstanding if such additional authorized shares are issued, such as dilution of any earnings per share and voting rights of current holders of common stock. The additional shares of common stock authorized by the approval of this Proposal 4 could be issued by our Board without further vote of our stockholders except as may be required in particular cases by our Charter, applicable law, regulatory agencies or the rules of Nasdaq. Under our Charter, stockholders do not have preemptive rights to subscribe for additional securities that may be issued by us, which means that current stockholders do not have a prior right thereunder to purchase any new issue of common stock in order to maintain their proportionate ownership interests in SCYNEXIS. The proposed amendment to increase the authorized number of shares of common stock does not change the number of shares of preferred stock that the company is authorized to issue.

The Board reserves the right, notwithstanding stockholder approval and without further action by stockholders, to elect not to proceed with the increase in the authorized shares of common stock if the Board determines that such increase is no longer in the best interests of the company and our stockholders.

If approved, the amendment would amend and restate paragraph A of Article IV of the Amended and Restated Certificate of Incorporation to read in its entirety as follows:

“A. This Corporation is authorized to issue two classes of stock to be designated, respectively, “Common Stock” and “Preferred Stock.” The total number of shares which the Corporation is authorized to issue is 155,000,000 shares. 150,000,000 shares shall be Common Stock, each having a par value of $0.001. 5,000,000 shares shall be Preferred Stock, each having a par value of $0.001.”

The approval of this Proposal 4 could, under certain circumstances, have an anti-takeover effect or delay or prevent a change in control of the company by providing the company the capability to engage in actions that would be dilutive to a potential acquirer, to pursue alternative transactions, or to otherwise increase the potential cost to acquire control of the company. The additional shares of common stock that would become available for issuance if this Proposal 4 is adopted could be used by us to oppose a hostile takeover attempt or to delay or